What is the Form M all about, why is the document required for importation, and at what stage is it required? Equally, how do one obtain Form M? What we intend to achieve with this piece of – article you might call it, is how to process and obtain Form M in Nigeria for import clearance purposes.

What is the Form M all about, why is the document required for importation, and at what stage is it required? Equally, how do one obtain Form M? What we intend to achieve with this piece of – article you might call it, is how to process and obtain Form M in Nigeria for import clearance purposes.

Table of Contents

ToggleWe employ you to call or send WhatsApp chats to us via +2349075526276 to process your Form M seamlessly. Additionally, you can reach us via email and other channels by clicking our ‘contact us’ page.

Summarized thus is the purpose of this article;

- At first, to build capacity in processing of electronic Form M,

- Simultaneously, to understand how to initiate and obtain Form M on the Single Window Trade Portal.

- Thirdly to enable Form M monitoring

Read Also: IMPORTATION LICENSE: REGULATORY AGENCIES

Less I forget, we are here to help you with all Form M and documentation issues in your import. Also, we take charge of your importation from the beginning to the finish. Contact us (+2349075526276) today for any hassle.

FORM M NIGERIA: SHORT HISTORY

Never mind, here are some history of electronic Form M, what I refer to as bits and pieces of Form M. if you are someone who like to know the background and some theories behind a practice, then this is for you. Otherwise, if you are my kind of person, skip and move-on to the main reason why we are here – how to open a Form M.

- The first official document needed to initiate shipment into Nigeria is the Form M.

- The first ever Pilot run of electronic Form M commenced on November 22, 2012 in the era of president Goodluck Ebele Jonathan and Ngozi Okonjo Iweala as finance minister.

- Full Implementation began December 06, 2012.

- Electronic transmission of Form M has replaced the hard copy. The essence was, and still is to reduce human interface and reduce or eliminate crude corruption

- Tax Identification Number (TIN) is now a prerequisite for electronic Form M processing. In fact, it is your key – username to the single window for trade website, which is the platform to obtain Form M

- Initiation and Approval of Form M is now on Trade Portal

- Additionally, the single window for trade portal allows for monitoring of Form M progress.

Read Also: CLEARING GOODS THROUGH CUSTOMS NIGERIA

FORM M PROCESSING: WHAT TOOLS DO YOU NEED?

By tools here I mean both apparatus, technical skills, regulatory certificates or permit from government agencies, and documents needed to initiate and obtain Form M in Nigeria. Maybe, you would have noted from my articles that I am a kind of straight-to-the-point kind of guy. As a result, I love putting things in bullet points. The following are what you need to open a Form M once you have passed the thinking stage to action stage.

- Internet access

- Computer systems; laptop or desktop

- Printer

- Scanner

- Ability to use a computer

- Pro forma invoice

- SON Product Certificate or Import Permit or NESREA Permit or NAFDAC permit for the item(s) of import. I will write a separate article on how to obtain regulatory certificates or permit from SON, NAFDAC, NESREA, etc.

- Marine insurance certificate

- Above all, you must have Your login detail to Nigerian single window for trade. I mean your tax identifier number (TIN which is your username), and the password created by you.

Read Also: IMPORTATION BUSINESS; STEP-BY-STEP IMPORTING INTO NIGERIA

FORM M: BEGIN PROCESSING

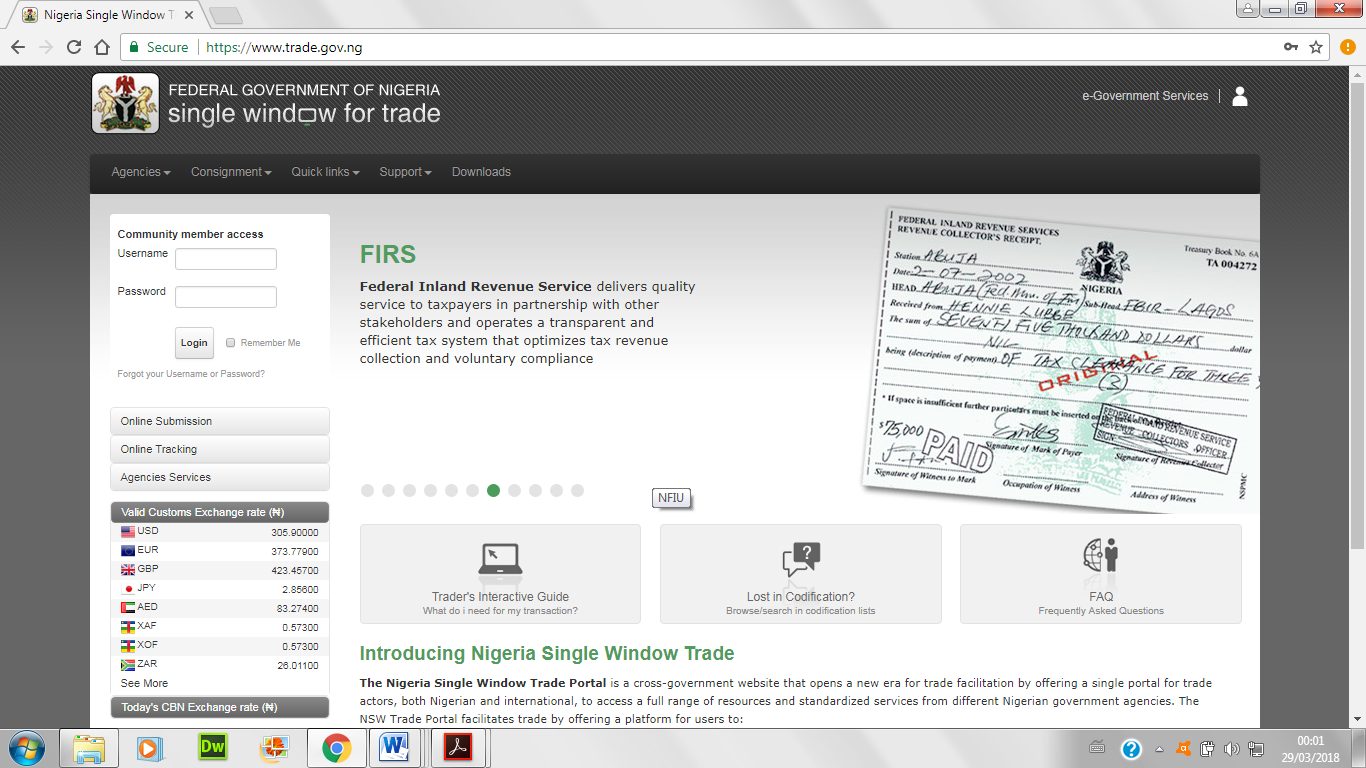

Login to Federal Government of Nigeria Single Window for Trade Portal to Process Form M:

Now you are ready to start processing your Form M. I would rather display the steps as images with few write-ups as directions to give it a more practical look it rightly deserves. First of all, open the trade portal and login with your TIN as username and the password created earlier with FIRS.

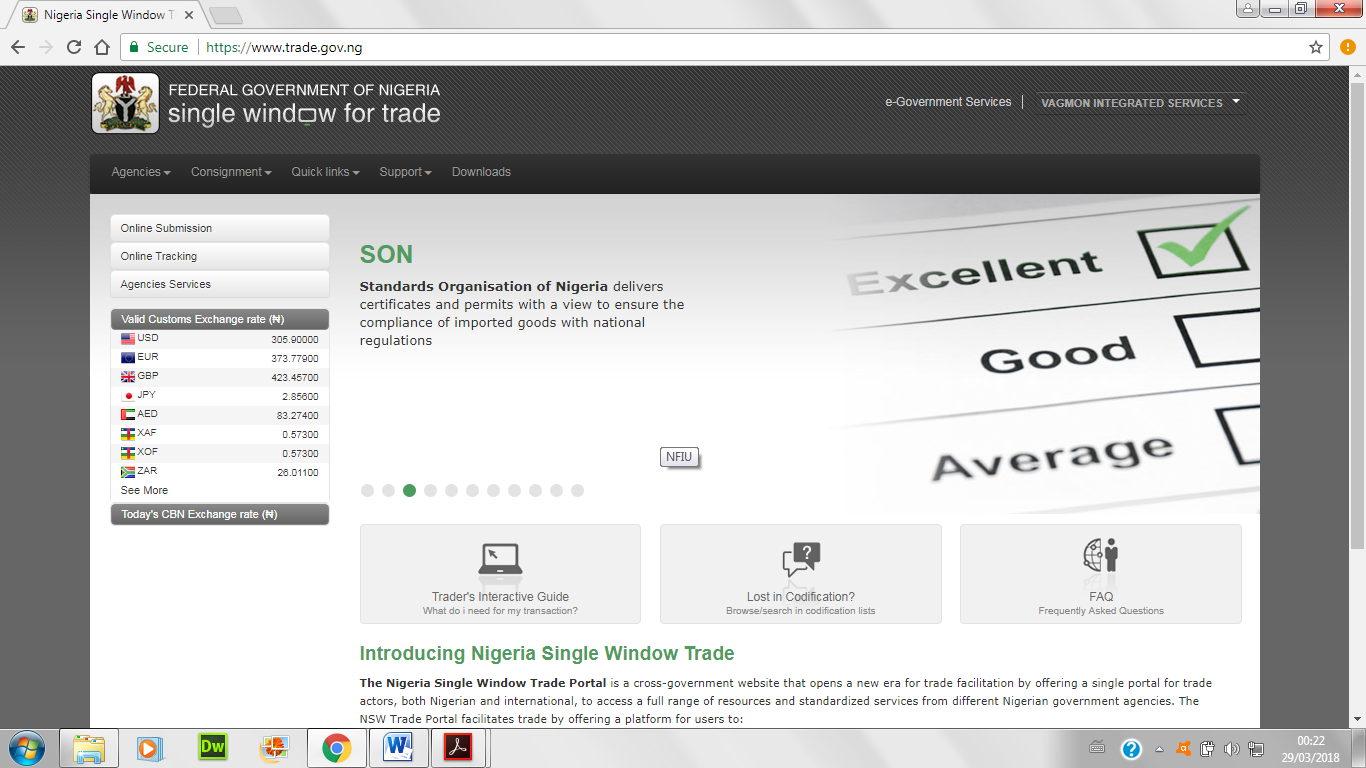

Once you have successfully logged-in, CBN Service homepage will be displayed. Furthermore, the upper right-hand part of the window will display your company name. I am using Vagmon Integrated Services for illustration purposes below.

Start Form M Application Proper

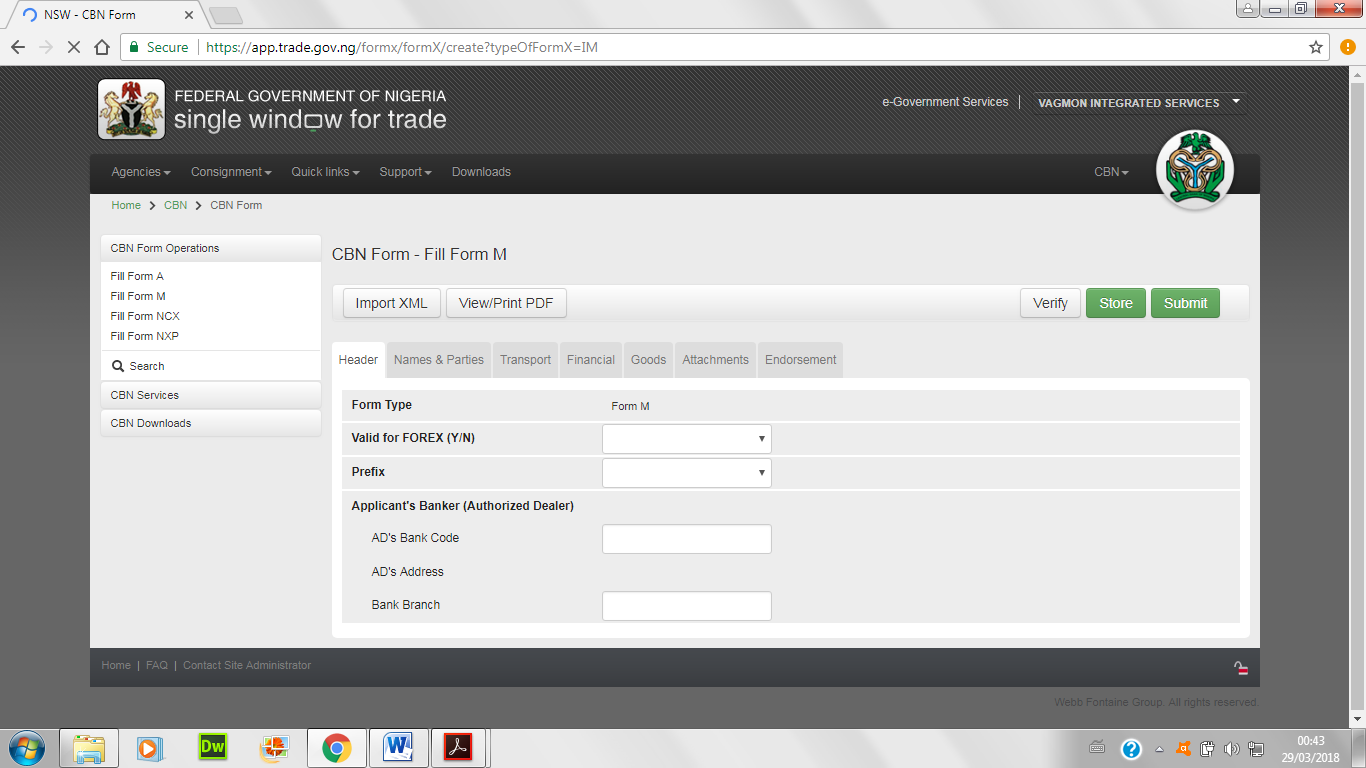

Secondly, to initiate or create new Form M, “click” on consignment, or online submission. “CBN Form Services” menu will appear, from the menu choose fill Form M.

Appreciate all the tabs in the row, beginning with “Header” tab, “Names and Parties” “Transport” “Financial” “Goods” “Attachment” and “Endorsement.” Enter necessary details in the fields displayed in fill Form M page. Let me explain those tabs and fields you need to fill a little more.

Read Also: FORM NXP NIGERIA: WHAT REALLY IS FORM NXP?

“Header” Tab

- Select Valid for FOREX status (Yes or No) this depends on if item is valid for FOREX or not.

- Also, select Form M prefix (BA or CB). Choose BA preface if item is to be inspected at the destination here in Nigeria, or BC if exempted from destination inspection. Usually many items fall under BA.

- AD’s Bank Code (Applicant Dealer Bank’s Code): simply click on this and select from the drop-down your bank.

- AD’s Address (Applicants Dealer Bank address) will be displayed automatically after you click on “verify” “store” or “submit” operations later on.

- Select Bank Branch: click and select the branch of your bank that will be processing your Form M, otherwise simply choose headquarter of your bank. Note that any branch of your bank can process your form. Consequently, you only need to notify your account officer by email to follow up for you.

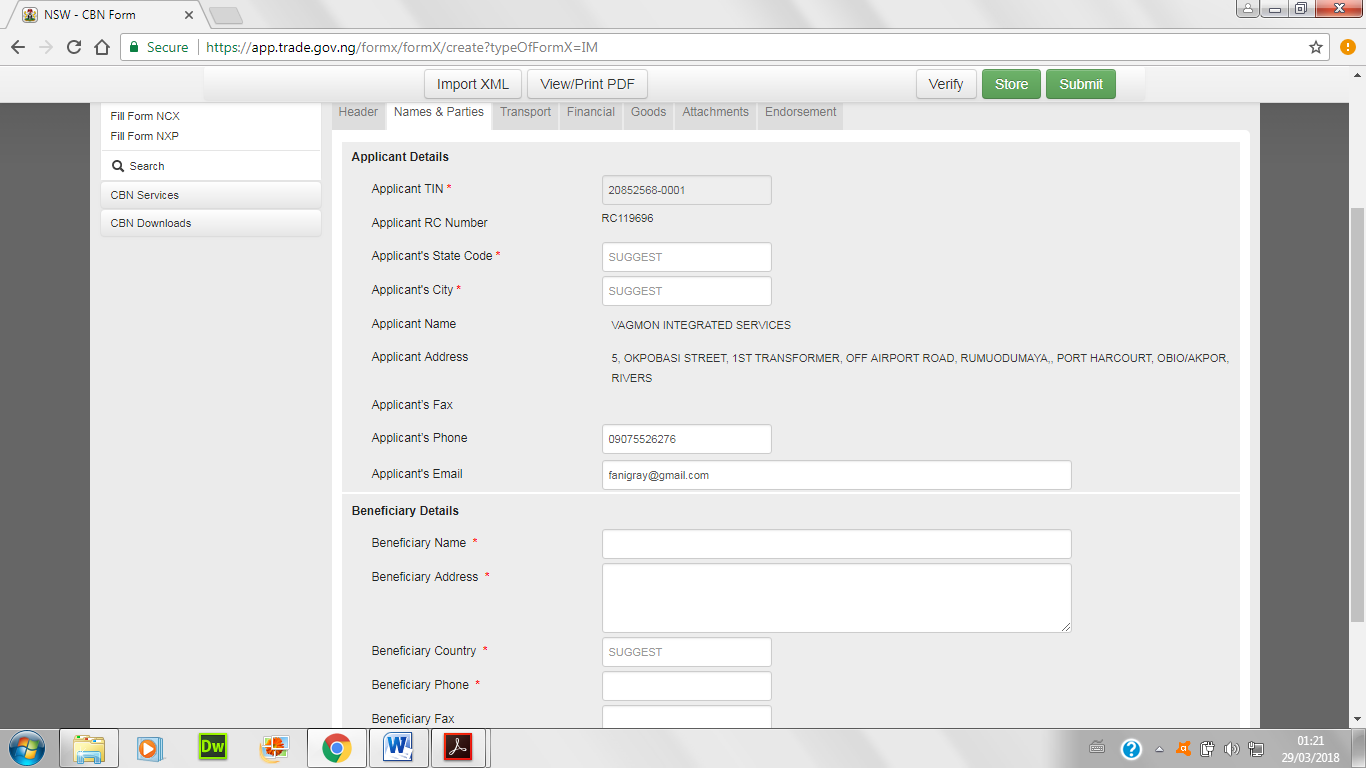

“Names and Parties” tab

Click on Names and Parties tab to capture the Applicant and Beneficiary details. Complete all the data entries. Some fields about the applicant are already embedded in the portal based on information supplied during company registration with CAC and TIN activation with FIRS. Thus, such information cannot be changed by yourself except requested from the two bodies. The applicant is you or the Agent, depending on whose TIN is in use. Beneficiary is the seller or shipper as stated in the pro forma invoice.

- Tax Identification Number (TIN) already embedded after login. TIN is usually in the form of xxxxxxxx-0001

- Enter Applicant State Code; this is the state your company was registered with CAC. This can also be where you stay to apply. Click and choose from menu.

- Enter Applicant City; the city of registration as in CAC or where you stay to apply. Click and choose from menu

- Applicant Name; the applicant name already there embedded on the site.

- Applicant Address; this is already there embedded based on what you supplied to CAC and FIRS.

- Applicant Phone; this is already there embedded and based on what you supplied to CAC and FIRS.

- Enter Beneficiary Name; type name of seller or exporter as found in the pro forma invoice.

- Enter Beneficiary Address; type the address of seller or exporter as found on the pro forma invoice.

- Enter Beneficiary Country Code; click on this and select the seller or exporter country as found on the pro forma invoice.

- Enter Beneficiary Phone; here you enter the beneficiary phone contact as found on the pro forma invoice. Otherwise, ensure you put just any number as this is a compulsory field

- Again Enter Beneficiary Fax Number; do nothing if you like as this is not stared

- Enter Beneficiary e-mail Address; enter the seller’s or exporter’s email

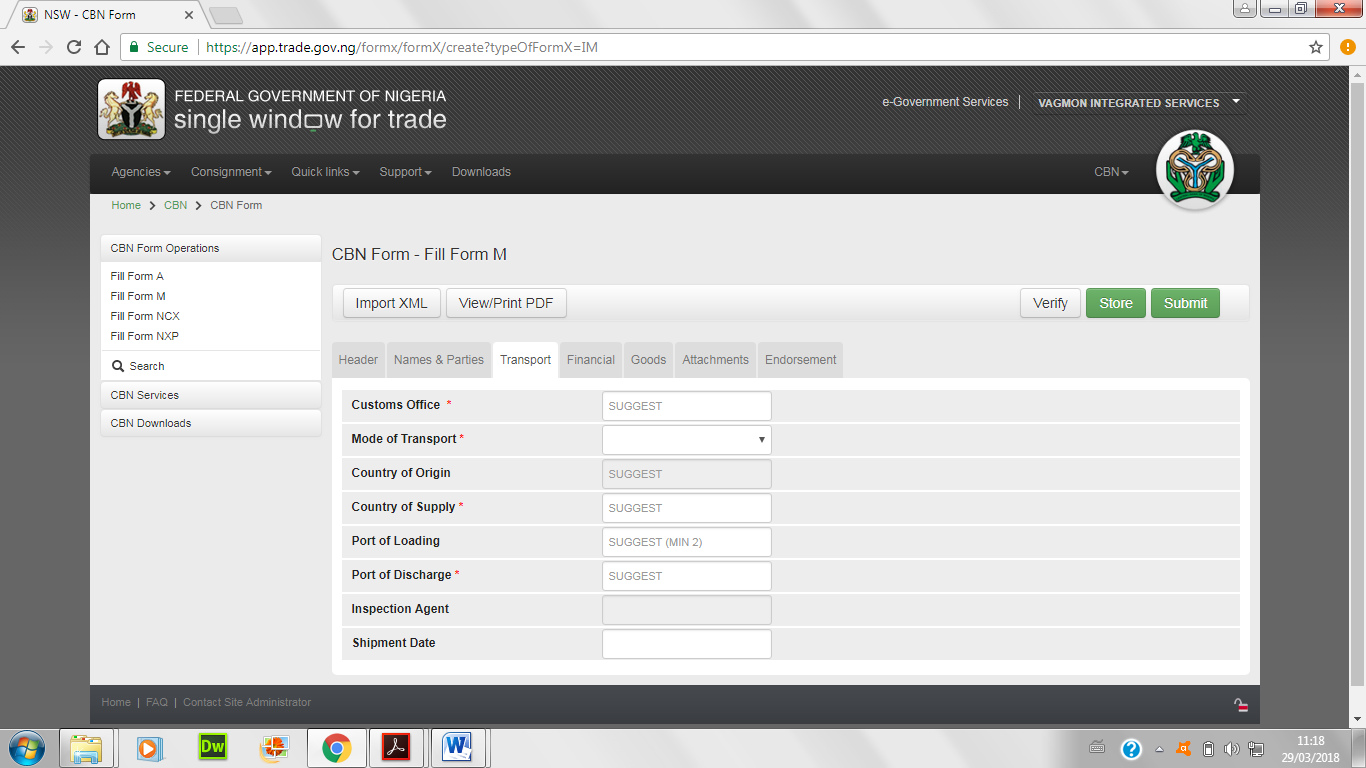

“Transport” tab

Click on “Transport tab” to capture the Mode of Transport details. Complete all the data entries

- Select Customs Office; click on this and select the airport or seaport unit of Customs where you goods are to be handled on arrival. Otherwise, just type the arrival port and it will show in a drop-down, then you select

- Select mode of transport; click to select air, road or sea as in your pro forma invoice.

- Select Country of Origin; do nothing, this field is left inactive because you could have a pro forma with multiple origins of goods. For instance an exporter in Cameron gathers goods from Gabon, Ghana, Gambia, Ethiopia, and sends to USA in one tranche shipment, with one invoice. Supply country is Cameron, origin country is various. When you finish entering the goods on the “Goods” tab, the system will add and display “Many” if the origin country is various. Otherwise, it will add the origin country for you. Do not worry about this at this point.

- Select Country of Supply; this is where your cargo or shipment is coming from as stated on the pro forma invoice. Make no mistake this is not always the same with country of origin. The country where goods are made are not necessarily where they are supplied. For instance I pick up a luggage produced in Nigeria to Ghana, and export to Gambia. Origin country is Nigeria, and supply country is Ghana.

- Select Port of Loading; what port was it sent from supply country? Your shipper or seller or supplier will put this on the pro forma invoice.

- Select Port of Discharge; again select or start by typing the port in the space provided and choose as stated in the pro forma invoice.

- Inspection Agent will be displayed automatically based on selected Customs Office.

- Enter Shipment Date (Not mandatory).

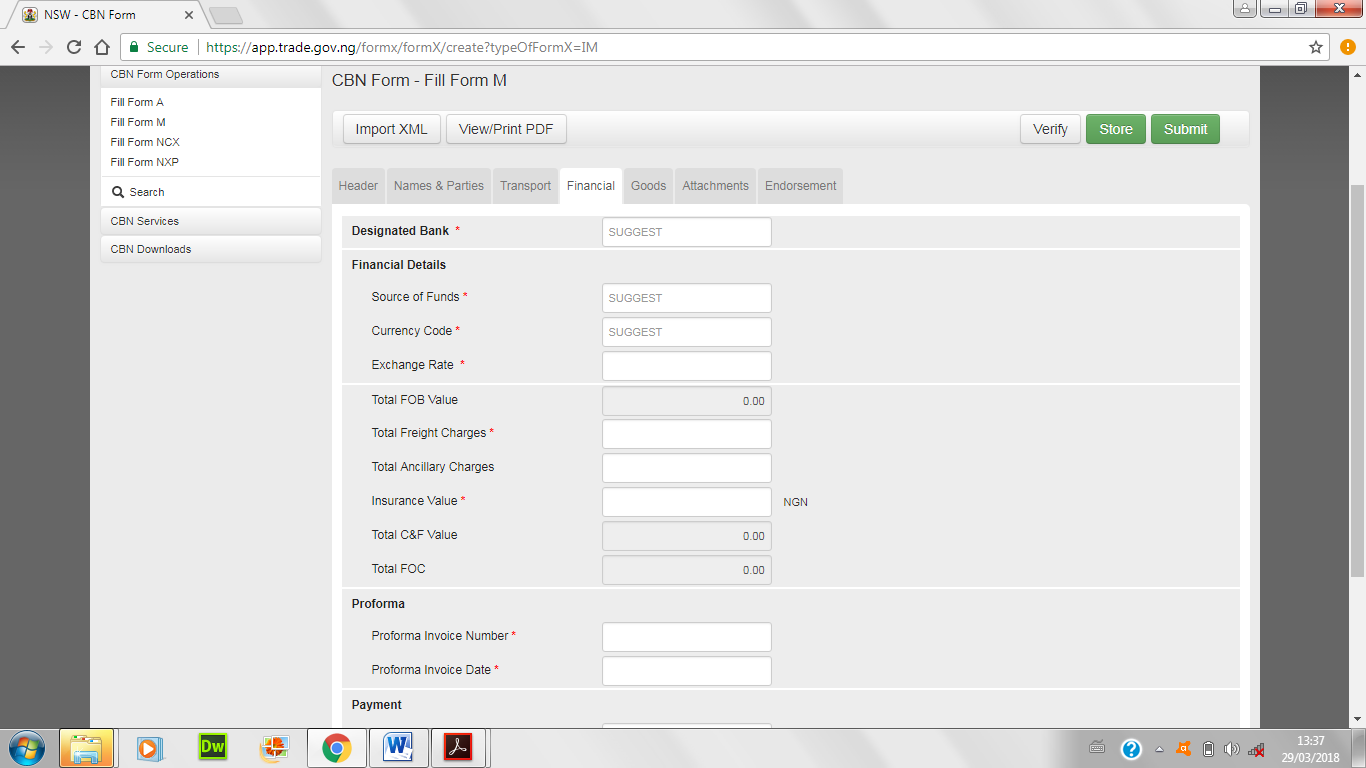

“Finance” tab

Click on “Financial” tab to capture the Bank and Financial details. Complete all data entries.

- Select Designated Bank; click and choose your bank.

- Select source of funds: options are; over-the-counter-purchases, accumulated syndicated funds, autonomous funds, CBN fund, domiciliary accounts, interbank purchases, offshore funds, other, purchases from DOM accounts. Decide which is applicable to you in advance. If not sure, ask your bank for advice or simply select other.

- Select currency code; click to select NGN, USD, EUR, depending on which is used in the transaction and as stated in the pro forma invoice (PFI).

- Enter exchange rate; Exchange Rate should not be less than 10% or more than 10% of CBN Rate, once you choose the currency, CBN rate shows by the side.

- Total FOB; FOB stands for Free On Board, I will explain what it means in detail in an article for shipping terms and meaning. Suffice to say it means all costs except freight incurred for importation of goods. FOB = Total value of goods + Ancillary Charges. Ancillary charges are charges not for value of goods, but for supporting services such as local transport of goods to port, or rapping, or packing, or any other of the kind. You do not have to enter this by yourself, but rather its auto calculated and displayed as you enter ancillary charges below, and type in goods detail in the “Goods” tab. Check to see that FOB, in the e-Form M corresponds with that in the PFI

More on Finance tab

- Enter Total Freight Charges as stated on the invoice.

- Enter total ancillary charge; as explained above, these are charges for supporting services during movement or transport of goods. The pro forma invoice shows the ancillary charges. Type the figure in the space provided.

- Enter insurance cost; insurance is calculated by the insurance company issuing the marine insurance coverage, and must be 110% of FOB or greater and in Nigerian currency. Type in the figure in the given space.

- Total C&F Value; this means total cost and freight. Total C&F Value = Total FOB Value + Total Freight Cost. Total C&F is auto calculated and displayed for you.

- The Total FOC; this means free of charge value in case you have such items. Its auto calculated and displayed for you. Total FOC = Summation of FOB for free of charge items. Again, my article on shipping terms and meaning will give clearer meaning of FOC. So you don’t have to worry as the system does the calculation for you.

- Enter Pro forma Invoice number; stated on the pro forma invoice

- Enter Pro forma Invoice date; stated on the pro forma invoice

- Select payment mode: how do you pay for your goods or items of import? The listed options are; letters of credit, bills for collection, advance payment, not valid for FOREX.

Read Also: CUSTOMS CLEARANCE CHARGES: COST OF CARGO CLEARING

- Select payment date; optional

- Select transfer mode; click and choose. Options include bank draft, mail transfer, others, swift, travelers cheque, telegraphic transfer. Select which applies, based on agreement between you and seller.

- Select term of delivery; click and select what term you agreed with seller or shipper. Options are cost and freight, cost, insurance and freight, carriage and insurance paid to, delivered at frontier, delivered duty paid, delivered duty unpaid, delivered ex quay, ex works, free alongside ships, free carrier, free on-board. Worry not about what these terms mean, Vagmon Integrated Services is here to help you. I will delve into all of these in my article for terms and meaning.

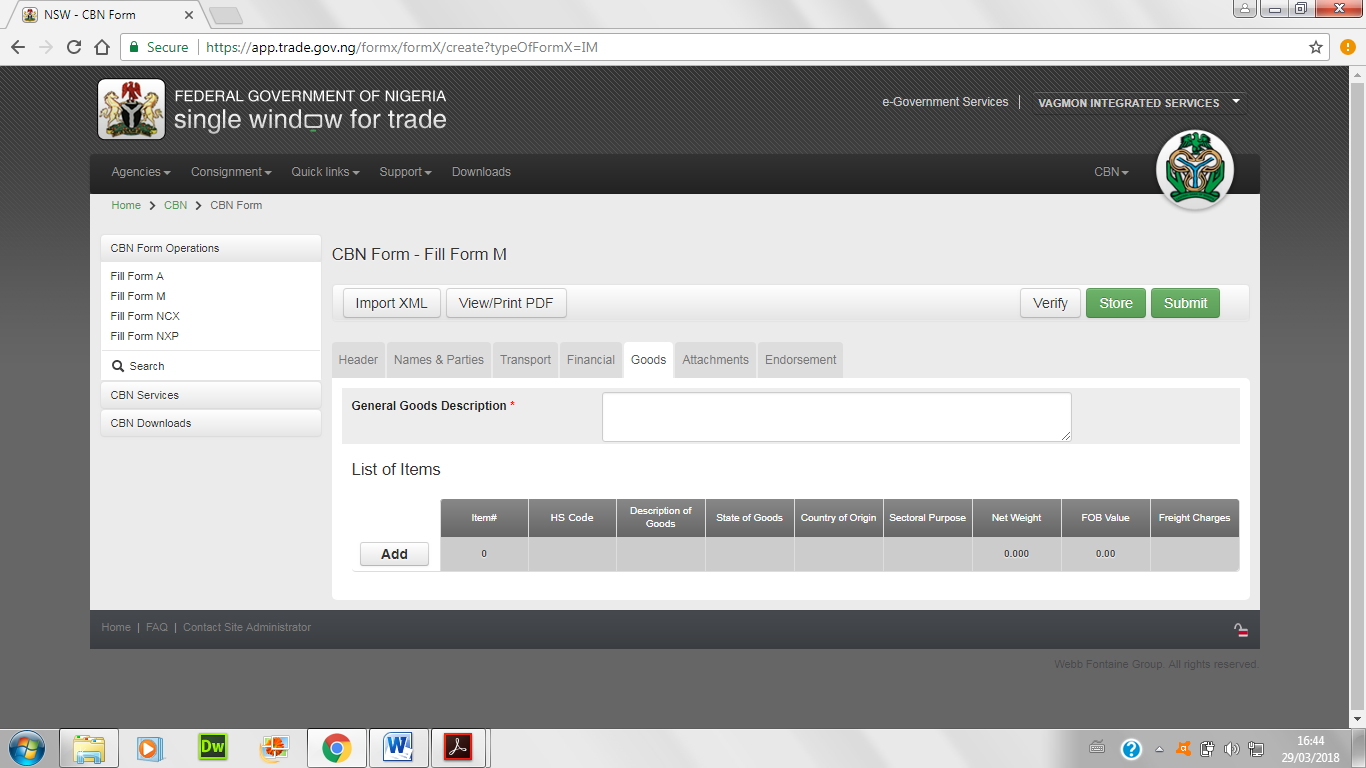

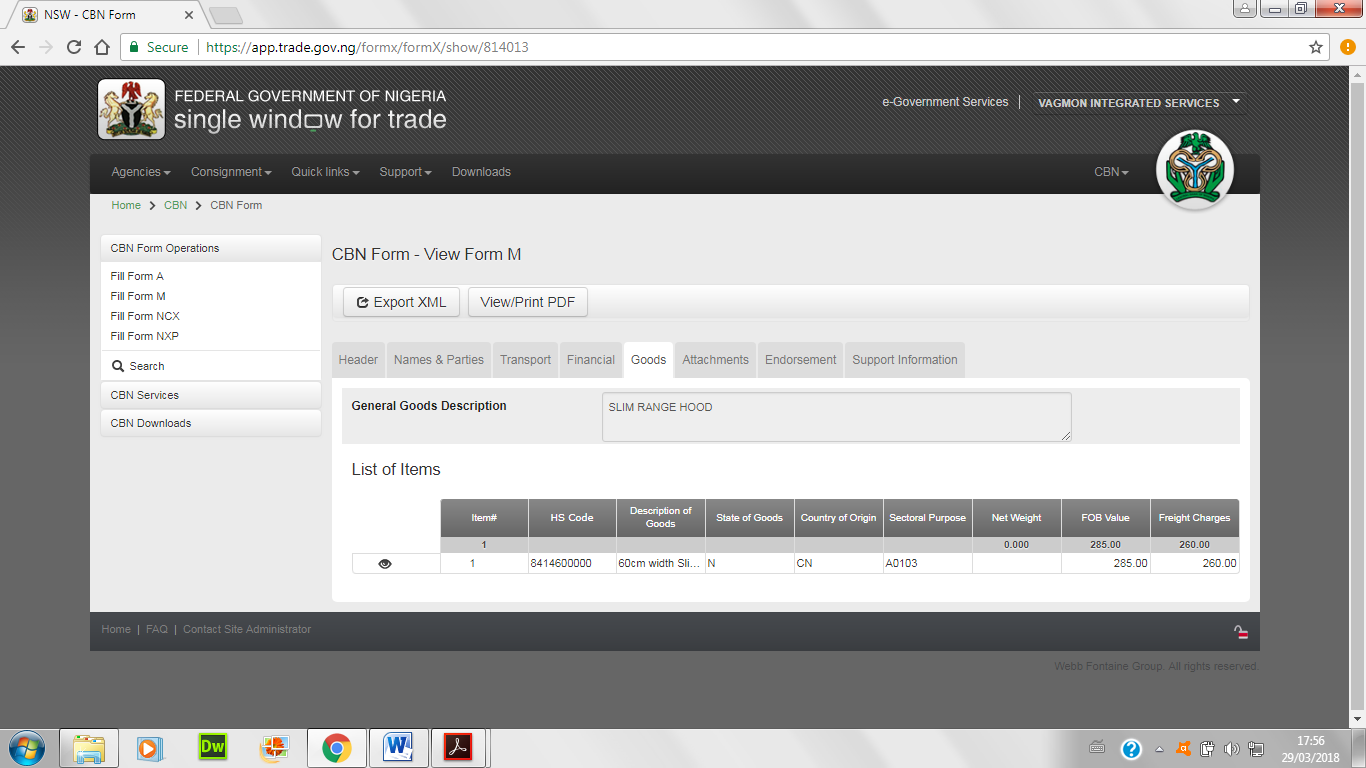

“Goods” tab

Click on Goods tab to add the item/ details. Enter the General Goods Description and add item details by clicking on Add button.

Complete the data entries.

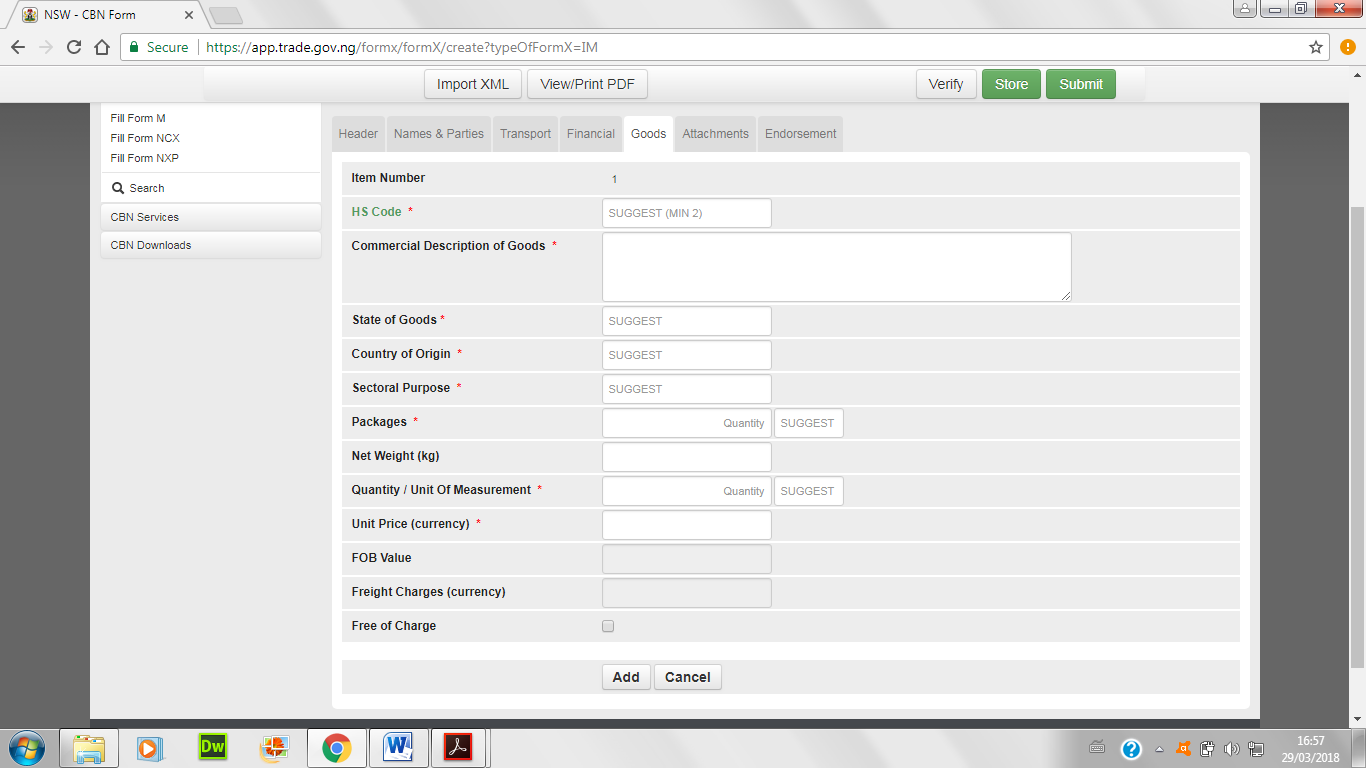

- Enter HS code. HS code stands for harmonized system code. Goods are group with HS Codes for tariff reasons. Type the HS code as in the pro forma invoice and see that when entering the HS code, the system will display the list of codes which contain the same value. Use the scrollbar to move up and down the list of codes and choose which matches what you have.

- Enter Commercial Description of Goods; type as described in the pro forma

- Select State of Goods; New or Used, click to select

- Enter Country of Origin; now, enter country of origin for each item

- Select Sectorial Purpose; select as spare parts, cosmetics, rubber, plastics, raw material, machinery, cement, soap, building, etc.

- Enter Number Packages; enter the packages as in the pro forma invoice

- Select Type of Packages; bag, barrel, bail, etc. or simply type unit and select unit from the drop-down

- Enter Net Weight (kg)

- Enter Quantity; type the figure

- Select Unit of Measurement; see pro forma invoice or simply select “unit”

- Enter Unit Price (currency); type figure

- The FOB Value will be automatically calculated and displayed. FOB Value = Quantity * Unit Price Freight Charges (Currency) will be automatically calculated and displayed. Freight Charges = (Item FOB/(Total FOB-Total Ancillary Charges)) * Total Freight charges

- Tick Free of Charge tick box if necessary

- Click on Add button to add the item details; otherwise Cancel button

- To add another item, repeat the above steps

Read Also: CUSTOMS HS CODES NIGERIA: HOW TO FIND HS CODES

Note that you could either edit or delete an added item by clicking on the item and the edit or delete button will popup.

Also remember to save as you work by clicking on the store button on the top right corner of the page.

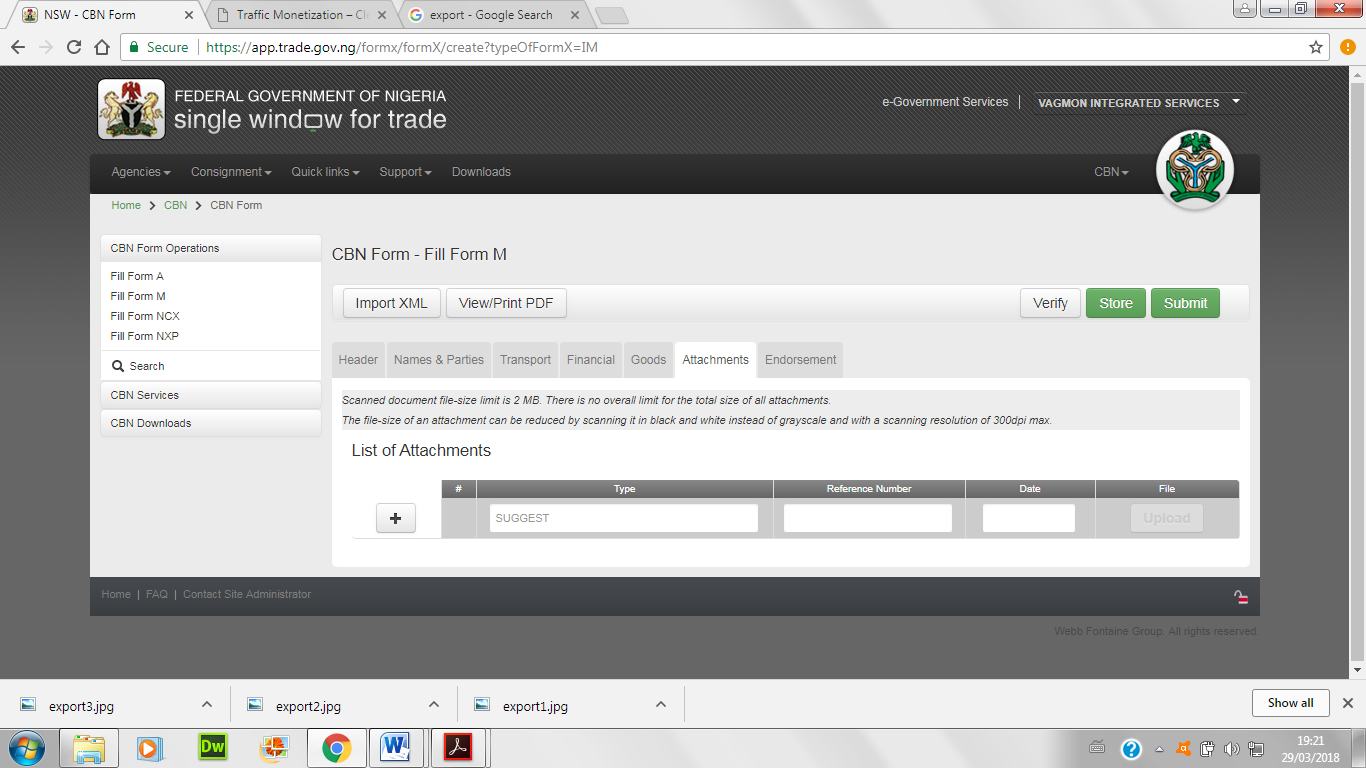

“Attachments” tab

Click on Attachment tab to attached required document.

- Select document type; usually the form m documents are the pro forma invoice, insurance certificate, and the SON PC or Import Permit or NAFDAC Permit, or NESREA Permit, etc.

- Enter the document reference or number

- Enter the date of the documents

- Click on attach file button to select the document.

Also read: IMPORTATION DOCUMENTS: HOW TO PROCESS SONCAP NIGERIA

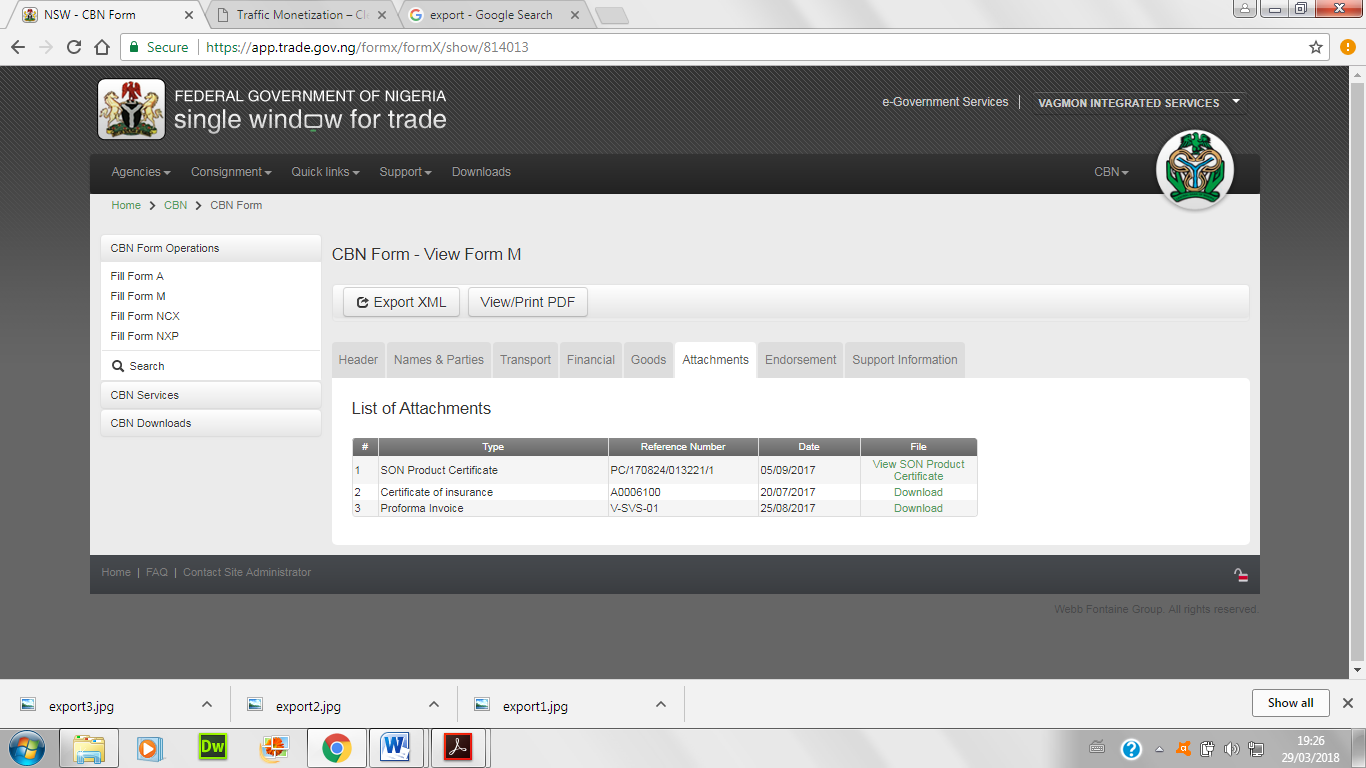

Therefore, if all things are properly attached then the page should be like below:

“Submit” Form M

Once done with all things, click verify first to check all things are fine. If no error message then it’s time to submit your form M. Finally, click submit to load your form m for processing by your bank and all relevant authority.

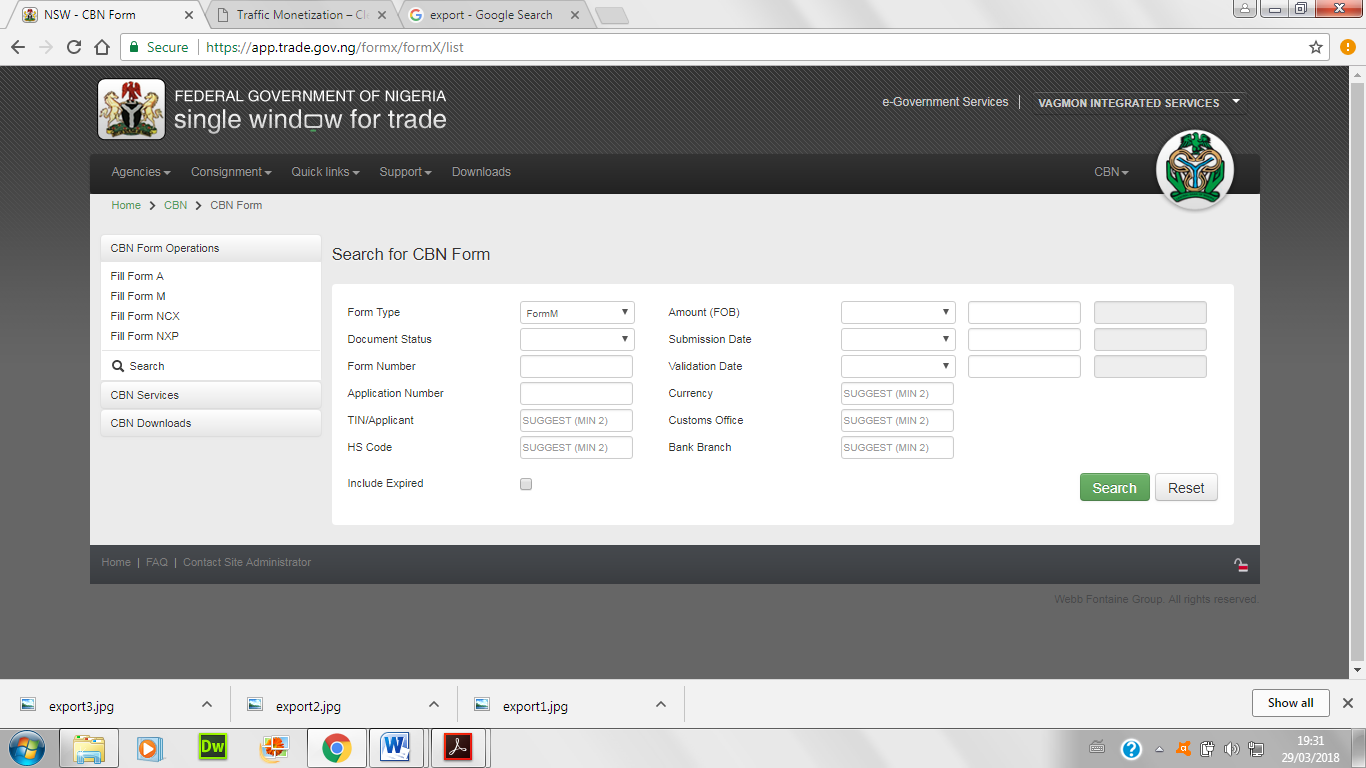

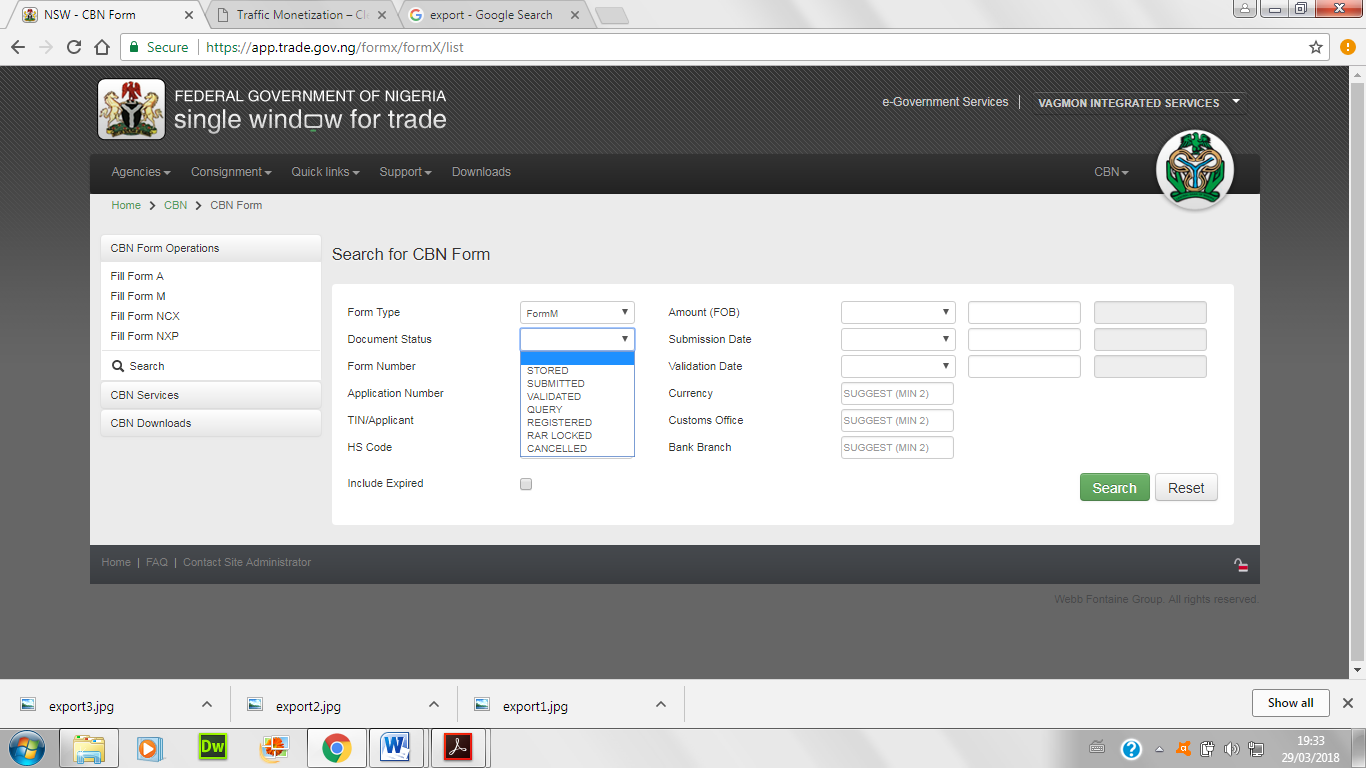

Even more, use the search button on the page to monitor progress of your Form M.

Read Also: FORM M REGISTRATION WITH MULTIPLE ITEMS

Conclusion:

Thanks for reading this article. Certainly, you now know how to obtain the first document required for importation into Nigeria. Lastly, you may have to obtain Form M for import clearance with as much as 500 items. Hence, I have written about how to handle multiple items. For help in cargo clearing, feel free to call us on +234(0)9075526276. You can also send an email to info@clearingandforwardingnigeria.com/fanigray@gmail.com.

Alternatively, you can watch the video below: