Customs HS Codes Nigeria? Many importers and exporters are having issues finding the right HS Code classification for items. What really are HS Codes? Where can you find one that would match the item description? Is there any link between the HS Code and the regulatory certificate for your importation to Nigeria? Furthermore, what link is there between HS Codes and duty payable? This article will answer all of these questions.

Customs HS Codes Nigeria? Many importers and exporters are having issues finding the right HS Code classification for items. What really are HS Codes? Where can you find one that would match the item description? Is there any link between the HS Code and the regulatory certificate for your importation to Nigeria? Furthermore, what link is there between HS Codes and duty payable? This article will answer all of these questions.

Table of Contents

ToggleRead Also: COST OF CLEARING CARGO: EXAMPLE OF NIGERIA

CUSTOMS HS CODES NIGERIA: WHAT ARE HS CODES

World Customs Organisation has just a way of classification of commodities in international supply chain. This classification or system of coding is what is called HS Code for brief. This harmonised commodity description is used by Custom regime of all member countries.

CUSTOMS HS CODES NIGERIA: WHERE TO FIND ONE THAT MATCHES YOUR COMMODITY

The Customs house brokers and freight forwarders are experts in matching your items to HS Codes. This article will walk you through on all you need to find a good HS Code for goods to Nigeria. So, to see the full codes used in Nigeria, click here. This will take you to the Customs Tariff Code, and then you can download the ever updated HS codes.

CUSTOMS HS CODES NIGERIA: WHAT LINK WITH REGULATORY IMPORT CERTIFICATES

Do you know that with the Customs HS Codes Nigeria, you could determine what agency certificate is needed for your import? Yes, this is a secret I want to share with you. First of all, why is this important? Sometimes, it may be extremely difficult to determine whether it is NAFDAC Import Permit or a SONCAP or even a NAQS permit that is needed to import certain items. This is the experience a client of mine had couple of months ago. Trying to be wiser, he wanted to do all things by himself without our usual services. Behold the importation of Soybeans with HS Code -1201100000 was the problem. If seen as seed, NASC/NAQS Import permits are needed. Otherwise, if seen as food material, NAFDAC Importation Permit is needed for soybeans. This is somewhat dilemmatic situation here.

Read Also: IMPORTATION LICENSE: REGULATORY AGENCIES

CUSTOMS HS CODES NIGERIA: WHAT AGENCY PERMIT?

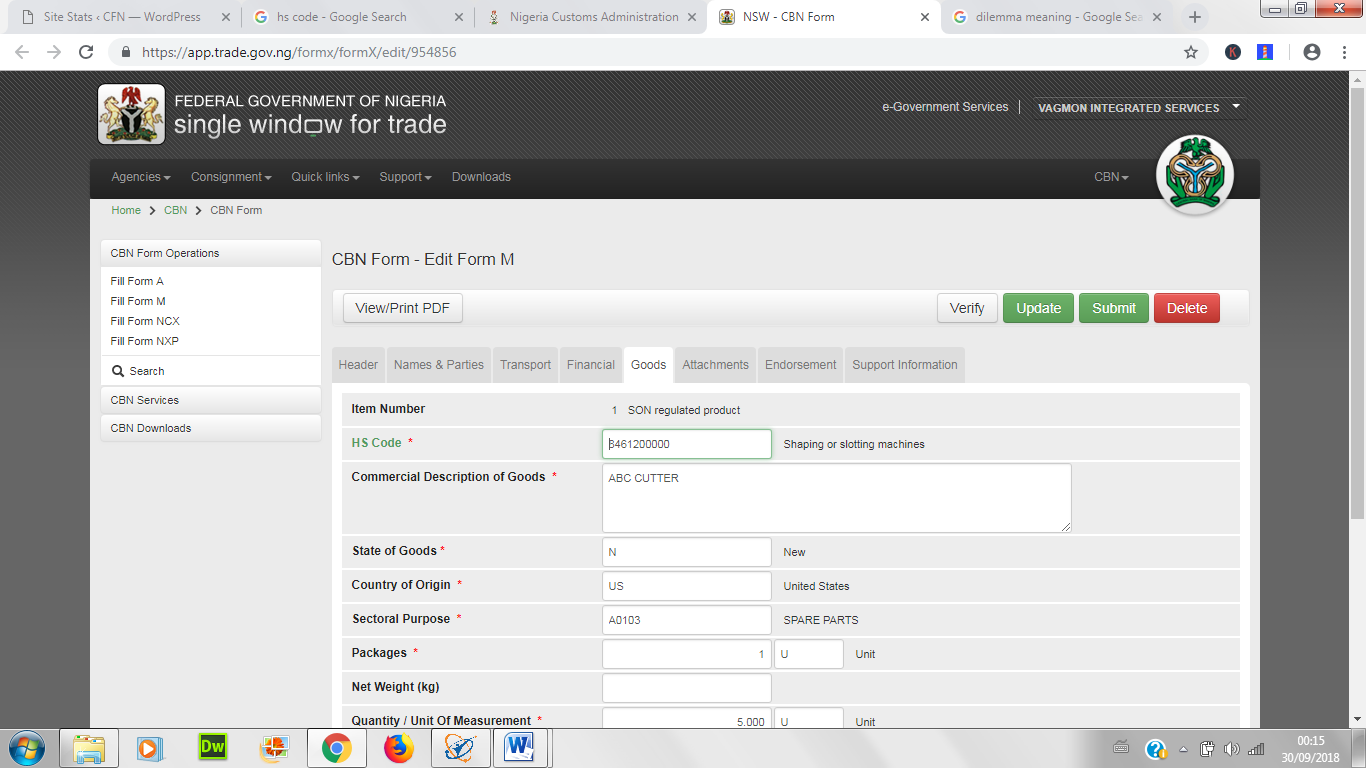

Now follow me as we do the following experiment. Click here to login to the Nigerian trade portal. Find the Form M page, and locate the goods button. Fill the item detail. As soon as the HS Code is entered, the regulator agency just pops up like in below image.

The window just tells you straight that item is SON regulated or NAFDAC regulated product. Hence, go process SON Product Certificate to get Form M.

CUSTOMS HS CODES NIGERIA AND CUSTOMS DUTY

The duty rate payable is also a direct function of HS Codes. Hence, the use of a documentation specialist like Vagmon Integrated Services is recommended. Contact us using the address displayed in the right-hand corner at the footer of this page.

Read Also: BULK FORM M NIGERIA: WHAT IS THE MEANING?

CONCLUSION:

Select HS Codes carefully. The reason is clear, wrong HS Codes means you could be told to attach NAFDAC, MANCAP, DPR or other regulatory agency certificate before you could import item. The duty rate payable is also a direct function of HS Codes; hence the use of a documentation specialist like Vagmon Integrated Services is cool.

Watch also;