There is a two-way Custom clearance procedure in every international export or import of goods. First, you have the origin Custom clearance procedure followed at the country of supply of goods. Similarly, there is the Import Customs clearance at the destination country.

Table of Contents

ToggleThus, in this article I will give explicit information on Import Custom clearance procedure in Nigeria. The article will reveal all steps importers need to take to initiate and finish custom clearance process. Consequently, this article will help importers reduce Custom clearance costs in Nigeria. In addition, feel free to reach me on +2349075526276 for more information.

CUSTOM CLEARANCE PROCEDURE AND MEANING:

Custom clearance procedure is the process of declaration of goods and value to the Customs Authority. The purpose of these declarations are; registration, levy or duty payment and even for security. Clearance process usually involves preparation and submission of required documents to the Customs Authority. Customs Authority carries out physical examinations of such goods before giving a clean report. Clearance procedure can be group into two, namely:

- Export Custom clearance procedure

- Import Custom clearance procedure

Our focus in this article is import custom clearance procedure in the Nigeria trading space. We will treat the export custom clearance procedure in another article.

CUSTOM CLEARANCE PROCEDURE IN NIGERIA

Step 1: decide on Tax Identification Number – TIN

You can either choose to import goods in your company name or in the name of another company. Preferably, most importers use the clearance agency company. Take the following steps if you want the cargo imported in your name or your company name. Otherwise, if you want to use the company owned by a clearance agent, kindly skip this entire step 1.

- Approach the Corporate Affairs Commission CAC to register a company. The company can be an enterprise, or a Ltd., or any other company acceptable by law. Note that tax payers with tax identification numbers, can as well import goods as persons.

- Take your company certificate (the 3 certificates given at CAC) to any office of First Inland Revenue Services – FIRS to apply and activate your Tax Identification Number (TIN). Thus, your TIN becomes visible on the Federal Government of Nigerian Single Window for Trade.

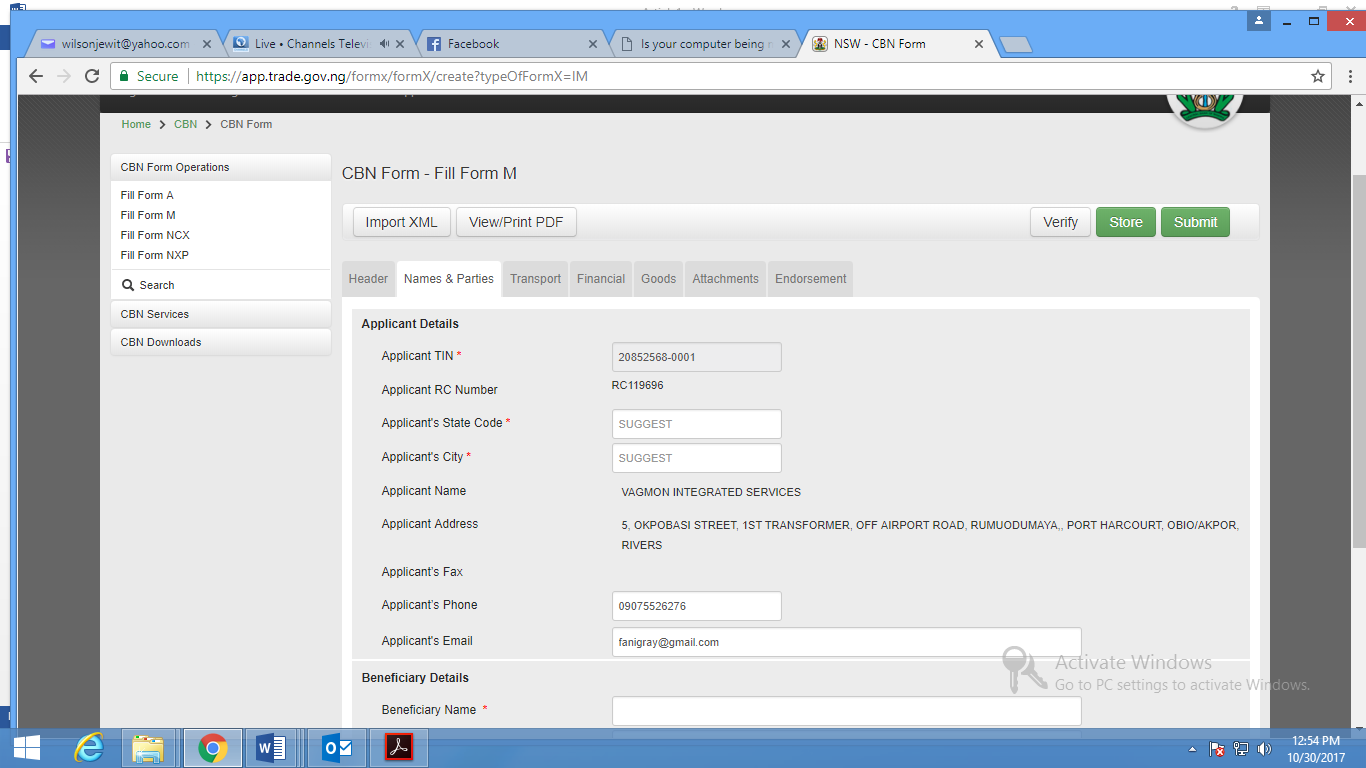

- Use the TIN (username) and the password so created with the FIRS to login to your page on the trade window website here. View your page and appreciate what you can do with your company. Vagmon Integrated Services can help process all things for you.

What you see from your page looks like below image.

Step 2: Pre-Importation Documents – Form M

Every standard conventional importation method in Nigeria requires Form M, which is the first official document. Documents needed to open Form M are the Proforma Invoice, Marine Insurance Certificate, and the SON Product Certificate. Others are SON Import Permit and NESREA Import Permit for used items. Let us look at these documents in detail.

Pro forma invoice:

Request the seller or manufacturer of the goods or items you want to import to issue you with a pro forma invoice. A pro forma invoice is an estimated quotation of items of import. The proforma invoice serves only for Customs purposes. It does not represent the actual invoice, and cannot be a demand or request for payment. We shall talk about the actual or commercial invoice as we move on.

In my next article, I will give template pro forma invoices. For the proforma invoice to be acceptable by Nigeria Customs, it must contain the following:

- Items description

- Unit prices of items

- Total amount of items

- Country of origin of goods

- Similarly, country of supply of shipment or cargo

- Means of transport (air, road, or sea)

- Estimated freight cost

- Seller or shipper’s(or consignor’s) address and contact detail

- Equally, buyer or consignee’s address and contact detail

Read also: WHAT IS A PROFORMA INVOICE IN NIGERIAN CONTEXT?

Marine or cargo insurance:

There are a hosts of insurance companies in Nigeria. Popular ones include AIICO Insurance PLC, NEM Insurance, Zenith Insurance, etc. Simply make contact with one and request for Marine Cargo Insurance Coverage. Otherwise, Vagmon can help you out on which insurance serves you the best.

Obtain SON product Certification (PC).

The SON PC is the SON confirmation that the products conform to Nigerian standards and technical regulations. SON PC is valid for 6 months to 1 year depending on the type obtained. Alternatively, you can obtain SON Import Permit, which is issued by regular importers for the same 6 months to 1-year period. PC is from the country of origin of goods, while Import Permit from Nigeria. Again, the importer has freedom to initiate just the importation of any item at any time using the PC. Whereas, SON Import Permit is for regular Importers. The permit requires importers to state all goods or items of import for the whole period during application stage.

SONCAP AGENCIES

There are five agents of SON that process SON certifications at Exporter or Seller’s origin country. These include INTERTEK, COTECNA, CCIC, and SGS. Approach any of these companies and ask to obtain SON certification for your product of import. Otherwise, shift this work to Vagmon to process on your behalf. We will deal more detail on how to process SON Certificates and regulatory certificates needed for imports and exports.

Read here: SONCAP PRODUCT CERTIFICATE: SHIPPING TO NIGERIA

Keep your bank informed:

Let your bank know you will be using your account with them to process form M. The bank usually debits the sum of NGN8000.00 or a little more from your account each time you request a Form M. some banks takes up the burden of processing the Form M for you.

Request Form M

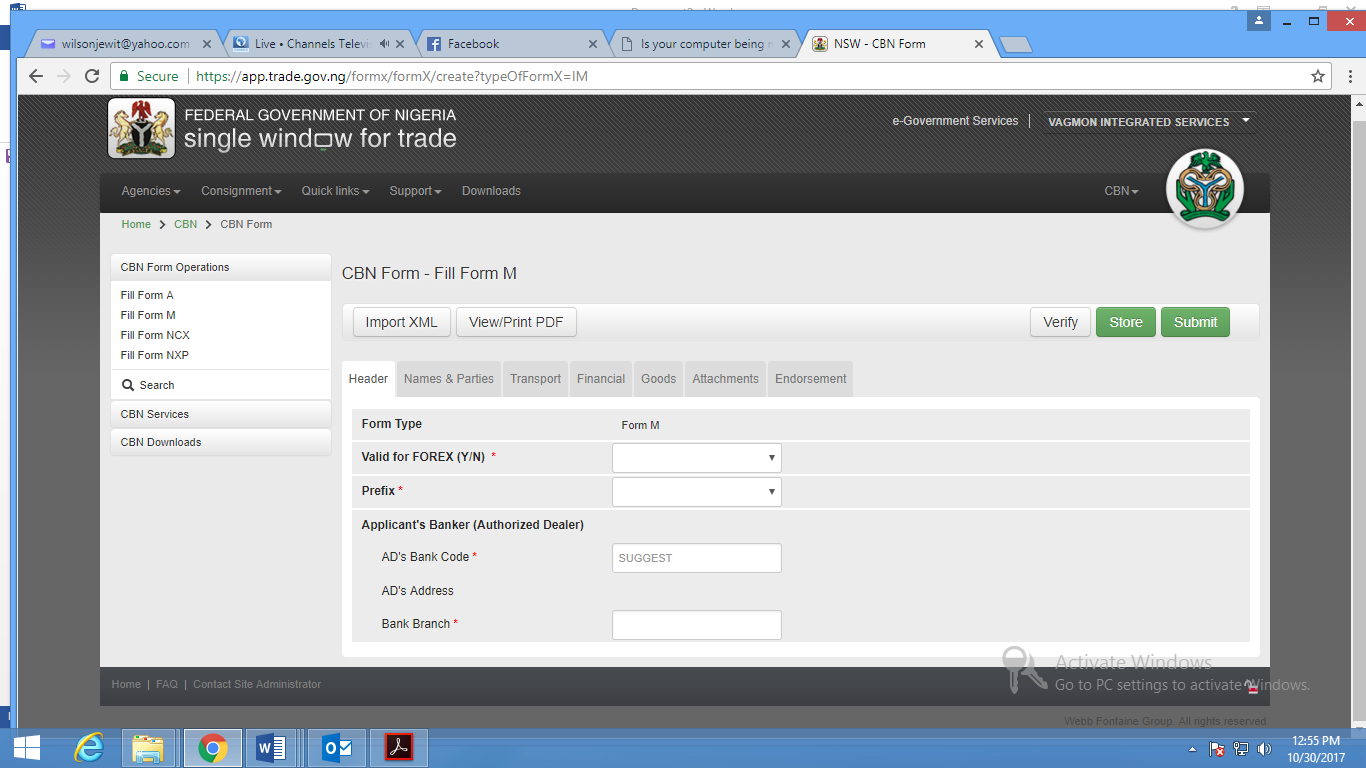

Use the form M documents stated above to request for form M via the Federal Government of Nigeria Single Window for Trade. In addition, using the detail created at stage 1 of this article, login to the trade portal.

Again, Vagmon can process form M on your behalf. Read below article for details on how to obtain Form M.

Again, Vagmon can process form M on your behalf. Read below article for details on how to obtain Form M.

Read also: FORM M NIGERIA: HOW TO PROCESS AND OBTAIN IT

Step 3 – cargo shipping

With the Form M is obtained, you are ready to ship your goods.

- Give the Form M to the seller or shipper, depending on the arrangement. We will discuss on how to find a shipping company in a separate article.

- The shipping company issues shipping document. This document could be an air waybill, bill of lading sea waybill or telex releases, depending on the shipping method. Check to add the form M number on the document. Air waybill is for cargoes coming by air, bill of lading or sea waybill for cargoes coming through the sea.

STEP 4: POST IMPORTATION DOCUMENTS – SONCAP, BILL OF LADING, ETC.

SONCAP

- The cargo shipping commences. Before the shipment is loaded, the SON inspection agent chosen from any of the three inspects the shipment and certifies it fit in terms of laid down regulations of SON.

- Seller or someone designated at the Form m stage approaches SON again to obtain SON Conformity Assessment Program Certificate – SONCAP. This sub-step is if you used SON PC in getting the form M. Otherwise, if SON Import Permit at the Form M stage this sub-step is not necessary. This is because SON Import Permit covers for Form M and Pre-Arrival Assessment Report. The difference between the SON PC and the SONCAP is that PC is a confirmation that the products conform to Nigerian standard and technical regulations. SONCAP confirms the product in a specific shipment comply with relevant Nigerian technical regulations and approved international, regional, or national standards.

- Seller arranges the real invoice (commercial invoice or shipping invoice). In addition, the Packing List, the Combined Certificate of Value and Origin – CCVO, with form M number on all documents.

- Activate your SONCAP or SON Import Permit against the above-mentioned documents with SON direct. This is to enable SON vet what you received from its agents. The essence is to ensure standards. I will talk more on the activation process in separate article, so keep reading.

PAAR

- Give the activated documents to the bank. The bank gives it to the Nigerian Customs for issuance of the Pre-Arrival Assessment Report – PAAR by the bank.

- Last, handover your PAAR & other clearing documents mentioned above to your Clearing Agent.

CUSTOM CLEARANCE PROCEDURE: THE CLEARANCE AGENT

The Custom Clearance agent begins his work from the following step and finalizes to the end. By taking the above steps in the custom clearance procedure, you have saved yourself of huge cost associated with documentation. Vagmon have the goal of helping you reduce cargo clearance costs.

Step 5 – Custom clearance procedure: the customs duty

This refers to the official and compulsory amount of money you pay to the Nigerian government for importing goods into the country.

- Assessment notice (customs Debit note) is either by a DTI Café or the clearing agency café. The document will show clearly total amount of duty payable to Nigerian Government through its agency – the Customs services. This is calculated using international standard. We will write a separate article to show you how to estimate Customs duty yourself from the comfort of your office.

- Next, the Consignee or Clearing vendor makes payment at Customs approved bank using the Customs assessment notice.

Step 6 – Custom Clearance Procedure: examination and booking:

- The Custom clearing agent will now proceed to sign and secure release stamps from different units in the Customs like the Enforcement unit, Customs Intelligent Unit, and Customs Gate control.

- After securing the release stamps are secured, signing of examination form by Government agencies in the Port is the next. Such law enforcement agencies like NDLEA, Anti-Bomb, Police, SSS, NAFDAC, SON, and others will be next.

Step 7 – Custom Clearance Procedure: issuance/payment of Debit Notes:

- The Clearance vendor will now obtain shipping company charges from the Liner agent, also known as shipping company that conveys your cargo from country of origin. This he does by presenting the Bill of Lading to the shipping, who will now issue an invoice or debit note. Examples of these companies; Grimaldi Agency, Maersk Line, APMDC, etc….

- Much like the sub-step above, the Clearing Agent or vendor will go to the terminal operator’s office to get an invoice for terminal charges. Terminal operators have role; to secure the container and provide handling equipment required to carry or covey container(s) for examination by Customs or scanning process in and around the Seaport.

- Pay both terminal and shipping companies’ charges in the approved banks.

- Some terminals require shipping company charges paid before examination.

- After payment to the shipping company and the shipping company releases cargo, the shipping company, issues Delivery Order to the consignee and transmits it to the terminal. Here is where all the documents required by the terminal operator for Exit note and Terminal Delivery Order come in; shipping company D.O, as well as other supporting documents, plus customs release documents. With all documents in place, the Terminal operator issues Terminal Delivery Order – TDO. Hence, cargo is released and ready for truck out to the Final Gate.

Step 8 – Custom Clearance Procedure: Final Clearing step:

- The truck proceeds to final Gate and wait for another round of documentation by the customs, e.g. confirmation of duty payment, endorsement and multiple registrations of documents. Moreover, here you have it; truck that conveys the container(s) should be on the way out of the Seaport to destination of interest.

- Furthermore, cargo delivered to your warehouse or designated point.

Read also: CLEARING AGENT NIGERIA: ROLE IN IMPORTS

Notes:

Note 1: Most banks will insist that supplier forward those documents mentioned in stage 3 above directly to them. However, some banks are soft, and will allow you to bring the document by hand delivery to them or scanned.

Also, note 2: Using this recommended process will help you reduce known bottleneck with custom. Never mind the cost of SONCAP from origin and the time it will take you to process the PAAR. You will be saving more money and at the same time enjoy secured clearing process.

Note 3: the process described applies to both air and sea freight with slight variations.

Lastly, note 4: Goods marked as used are with NESREA certificate instead of SON PC/SONCAP.

In Conclusion:

Goods imported from one country to another would have to undergo two Custom clearance Procedure. Firstly, there is clearance at the supply country and the other at the destination country. Accordingly, this article has discussed in detail the Import Custom Clearance procedure for reduced Customs clearance costs in Nigeria. Finally, we do Custom clearance of some classified goods without rigidly following the itemized Custom clearance procedure in Nigeria. For this reason, contact us at +2349075526276 today.

Recommended for you: