Single Goods Declaration (SGD) Nigeria? Have you tried to import goods to Nigeria before and Customs Broker mentioned single goods declaration to you? Alternatively, could it be that you are trying to export goods out of Nigeria and single goods declaration (sgd) is one of the must-do documents? What really is single goods declaration document? How can you generate SGD? Who has the license to generate SGD for import cargo clearance in Nigeria? This article is will provide answers to these questions.

Single Goods Declaration (SGD) Nigeria? Have you tried to import goods to Nigeria before and Customs Broker mentioned single goods declaration to you? Alternatively, could it be that you are trying to export goods out of Nigeria and single goods declaration (sgd) is one of the must-do documents? What really is single goods declaration document? How can you generate SGD? Who has the license to generate SGD for import cargo clearance in Nigeria? This article is will provide answers to these questions.

Table of Contents

ToggleThus, in this article, we shall define what Single Goods Declaration means. We will also show hands-on-tool way of generating SGD. The article will answer the question as to what tools to use to generate SGD.

Read Also WHAT IS DTI: NIGERIAN CUSTOMS, BUSINESS OPPORTUNITY

SINGLE GOODS DECLARATION (SGD) NIGERIA: WHAT IS SGD?

As is seen from the name, SGD is a declaration document. The SGD is a Customs document, which shows unabridged details of imported or exported goods. In some countries, SGD has the name Customs Declaration Document. In Nigeria, SGD is to be got electronically by the importer, Customs Broker, or DTI café. For the exporter, SGD is given as a physical document to be filled by him or his representative. This article will restrict itself to how to generate SGD for the importer of goods only.

Therefore, the question of who generates SGD is answered. In the following sections, we will see more about what the importer or his representative needs to have to generate SGD. So, keep reading.

DIFFERENCE BETWEEN SGD AND SAD

Before we proceed to show how to fill the SGD electronically, let us differentiate between SGD and SAD. SGD as we have seen is an abbreviation for Single Good Declaration. SAD stands for Single Administrative Document. SGD gives birth to SAD. In Nigeria context, SGD is detailed, and shows the declaration for each good in the volume of goods. SAD is the abridged, and contains summary of all the SGDs in a particular volume of goods. Hence, SAD is the summary of SGD. Both SGD and SAD are generated through the process of data capturing.

SINGLE GOODS DECLARATION: DATA CAPTURING

SGD and SAD are got through a process called Data Capturing. Data capturing is a process of retrieving information for specific purpose, using methods other than entering. Lexicographers differ in their definition of what data capturing is, so you could look that up. The purpose of this article is not to define data capturing, but to show how to generate SGD and consequently SAD. The method of generating SGD/SAD is called data capturing process. Let us see how in the following sections.

TOOLS NEEDED FOR DATA CAPTURING

To data capture, or to generate SGD, the importer or customs Broker need to have the following:

- Must have license to carry on business as a customs Agent

- The said license must be registered in the Customs Command where goods are delivered.

- The company (importer or Agent) must have a login to the community section of the Nigeria Single Window for trade.

- Import documents like the commercial invoice, bill of lading, Form M, etc.

- Other Customs documents like the PAAR.

- Computer system and internet access.

Let us now begin the business of data capturing.

Read Also FORM M NIGERIA: HOW TO PROCESS AND OBTAIN IT

HOW TO GENERATE SINGLE GOODS DECLARATION – SGD

Assuming all the tools and resources enumerated for SGD processing are complete, now you are ready to proceed.

LOGIN TO THE COMMUNITY SECTION OF NIGERIA SINGLE WINDOW FOR TRADE

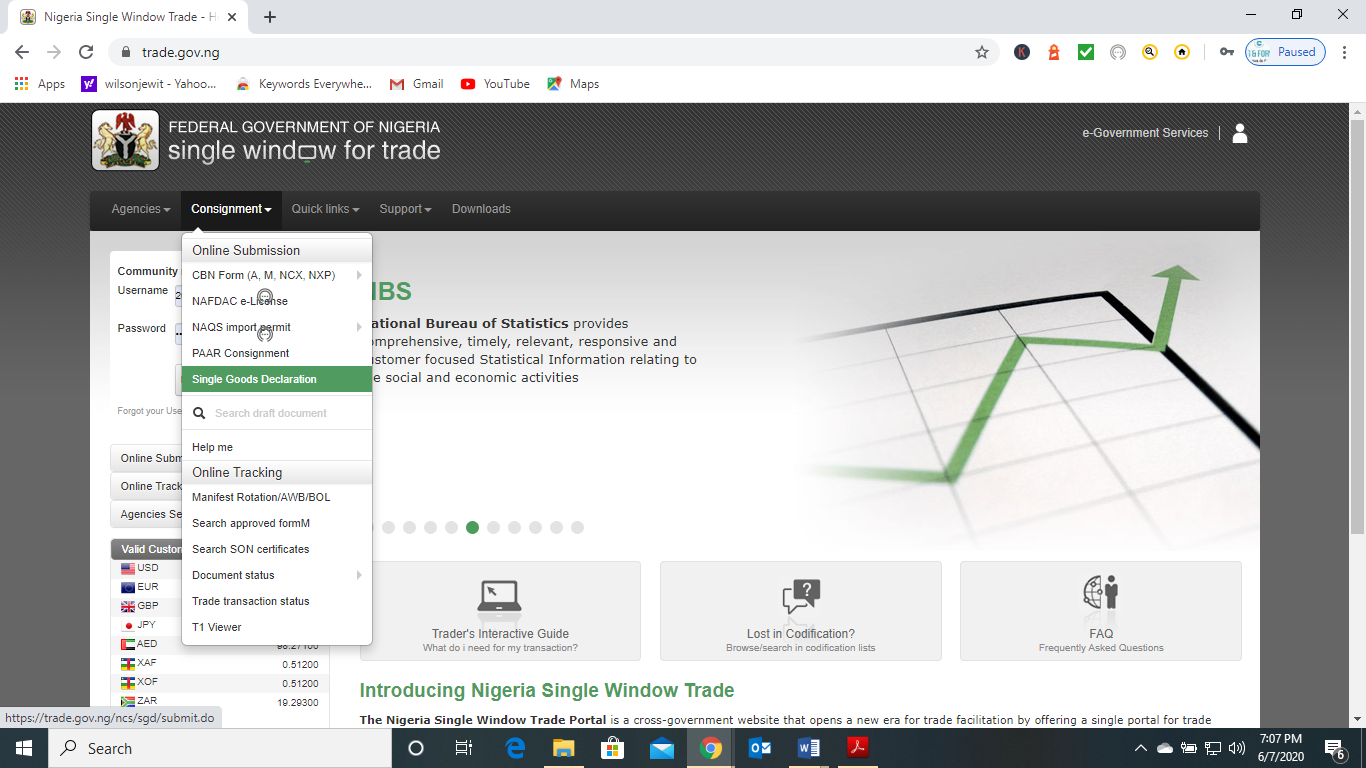

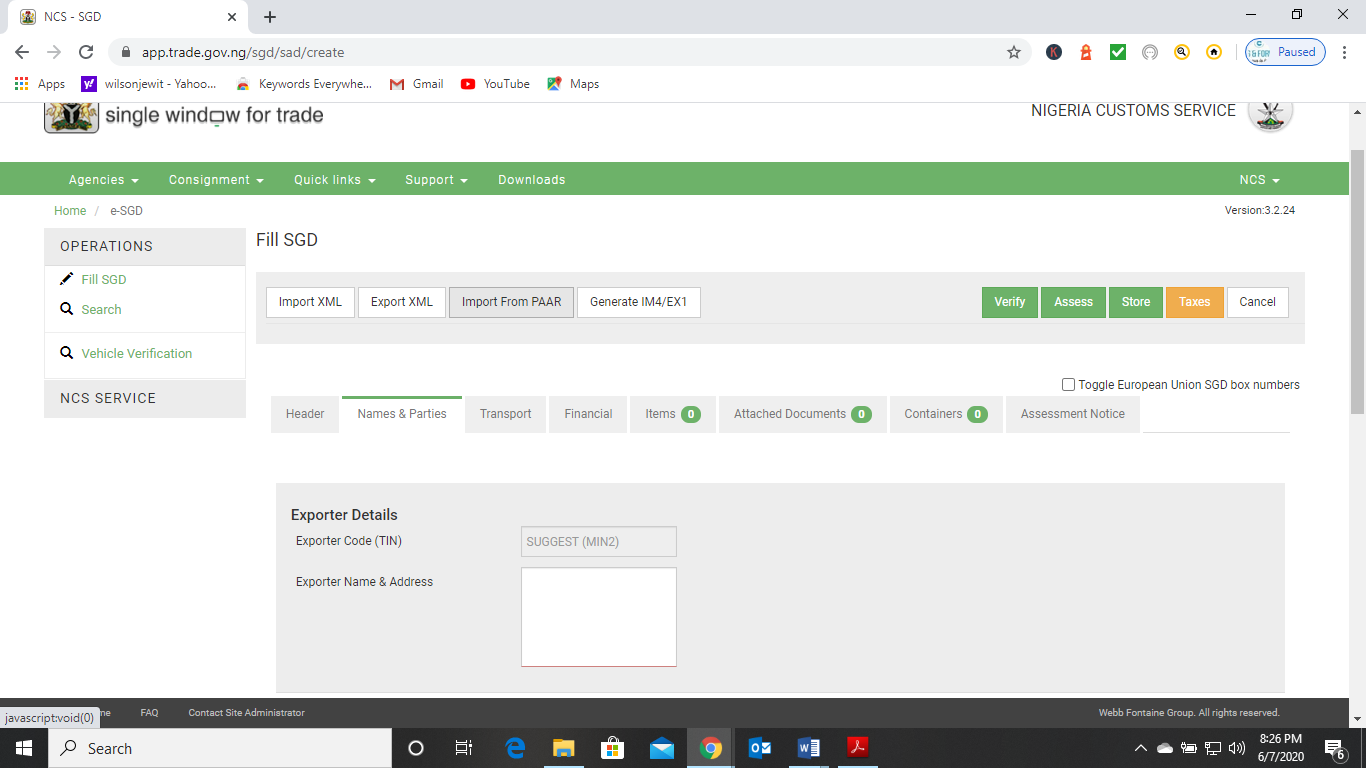

Now you are set to begin processing your SGD. Let me rather display the steps as pictures with few writings as directions to make it more practical. Open the trade portal www.trade.gov.ng and select Single Goods Declaration from the Consignment dropdown menu.

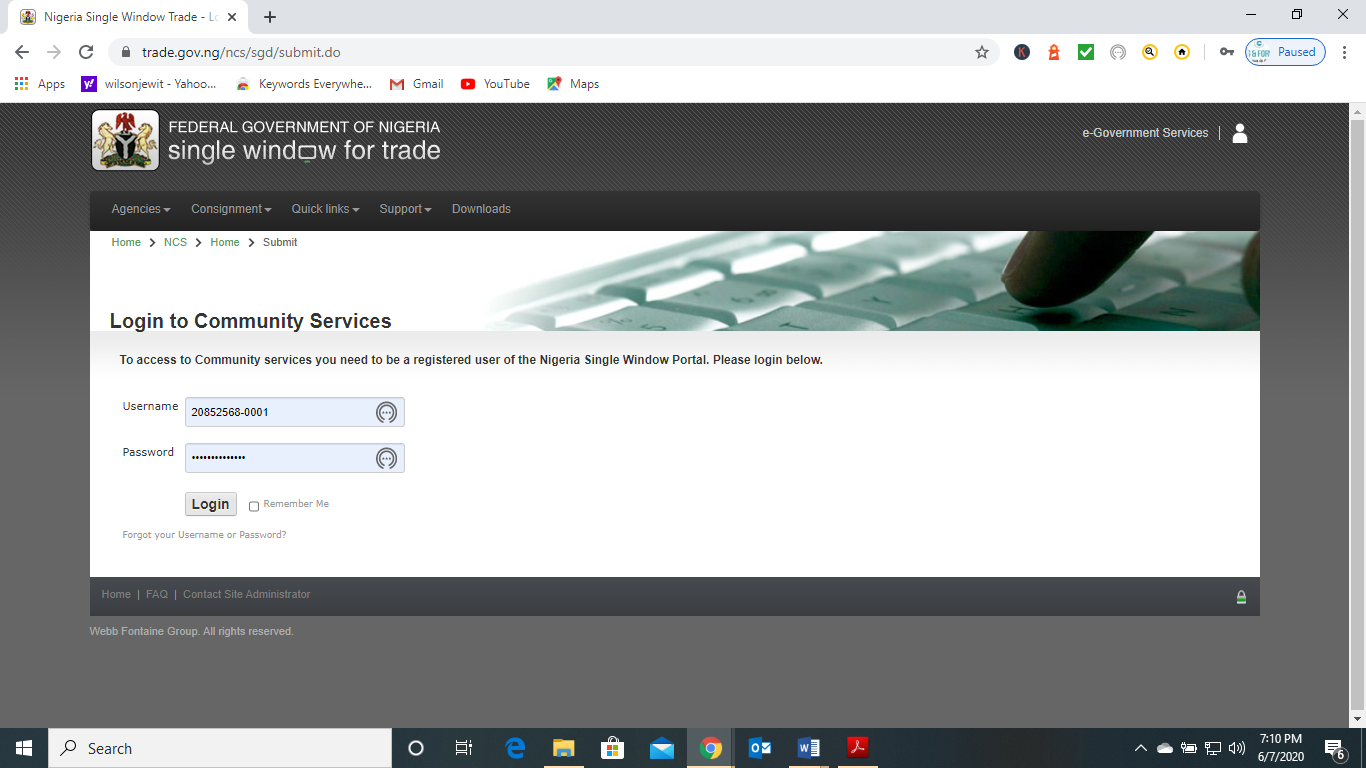

Login with your username and the password created earlier with the Customs Command. We are using Vagmon e-Grup & Logistics as an illustration in this article.

START FILLING SGD PROPER

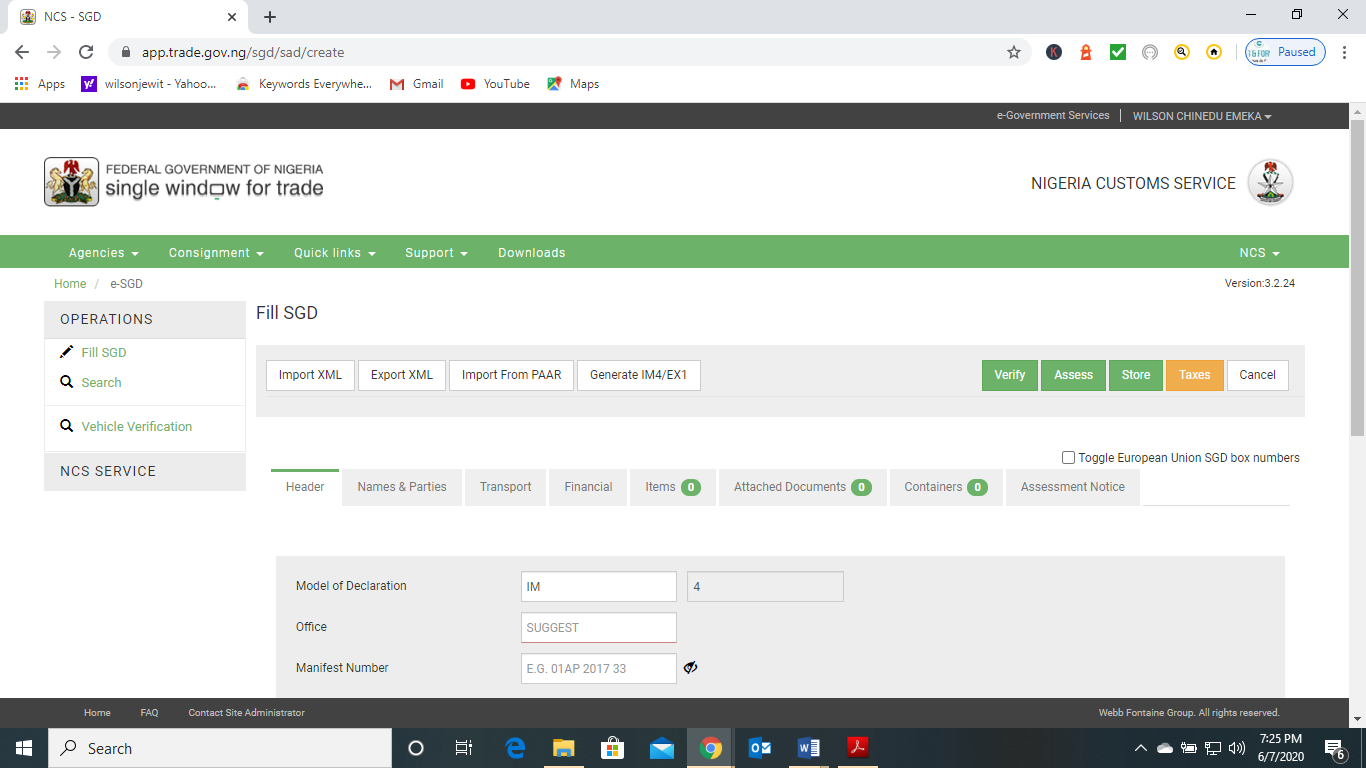

The first page displayed here is the ‘header’ tab, others are ‘Name and parties’ ‘Transport’ ‘Financial ‘Items’ ‘Attached document’ and ‘Container Assessment’ Let me explain the tabs and fields you need to fill a little more.

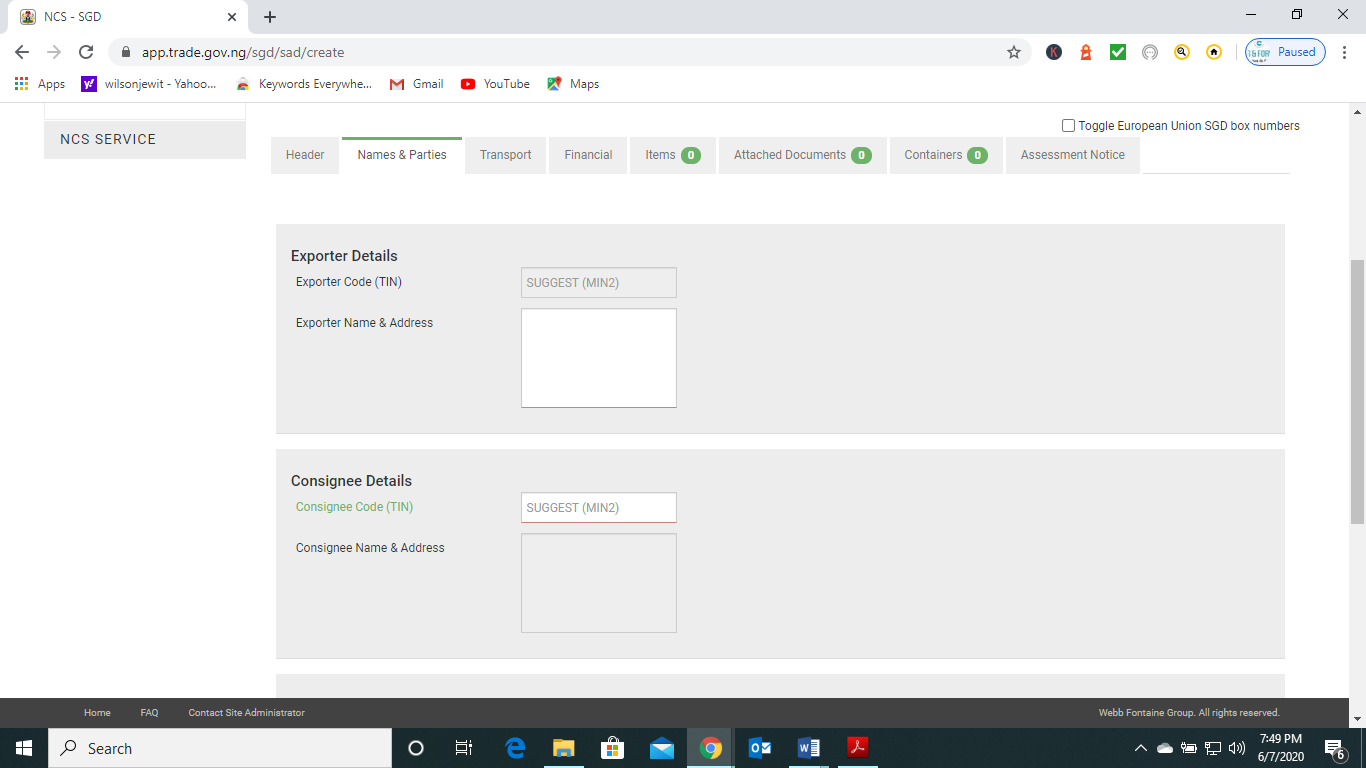

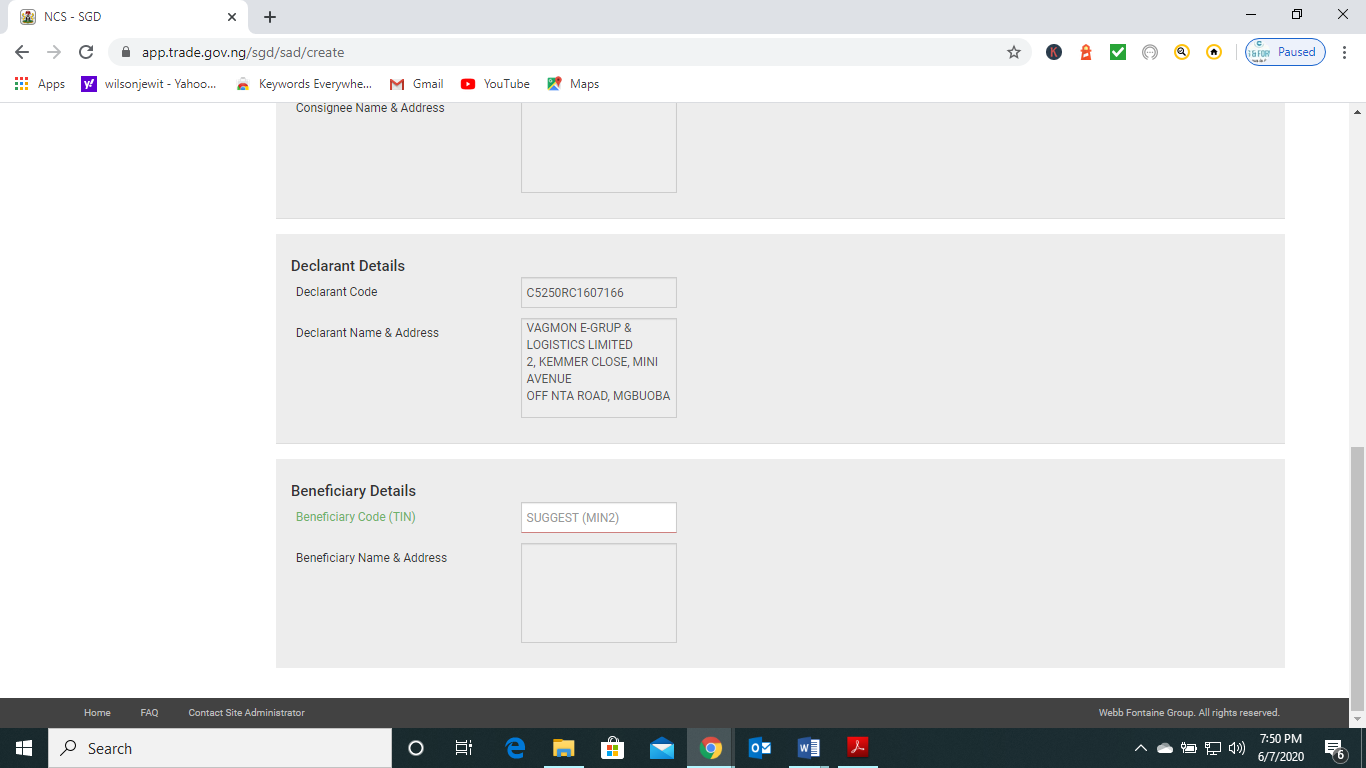

‘Name and parties’

You might wonder why we have to jump the ‘header’ tab to the ‘names and party’ tab. The reason is that we want to import do some data importation.

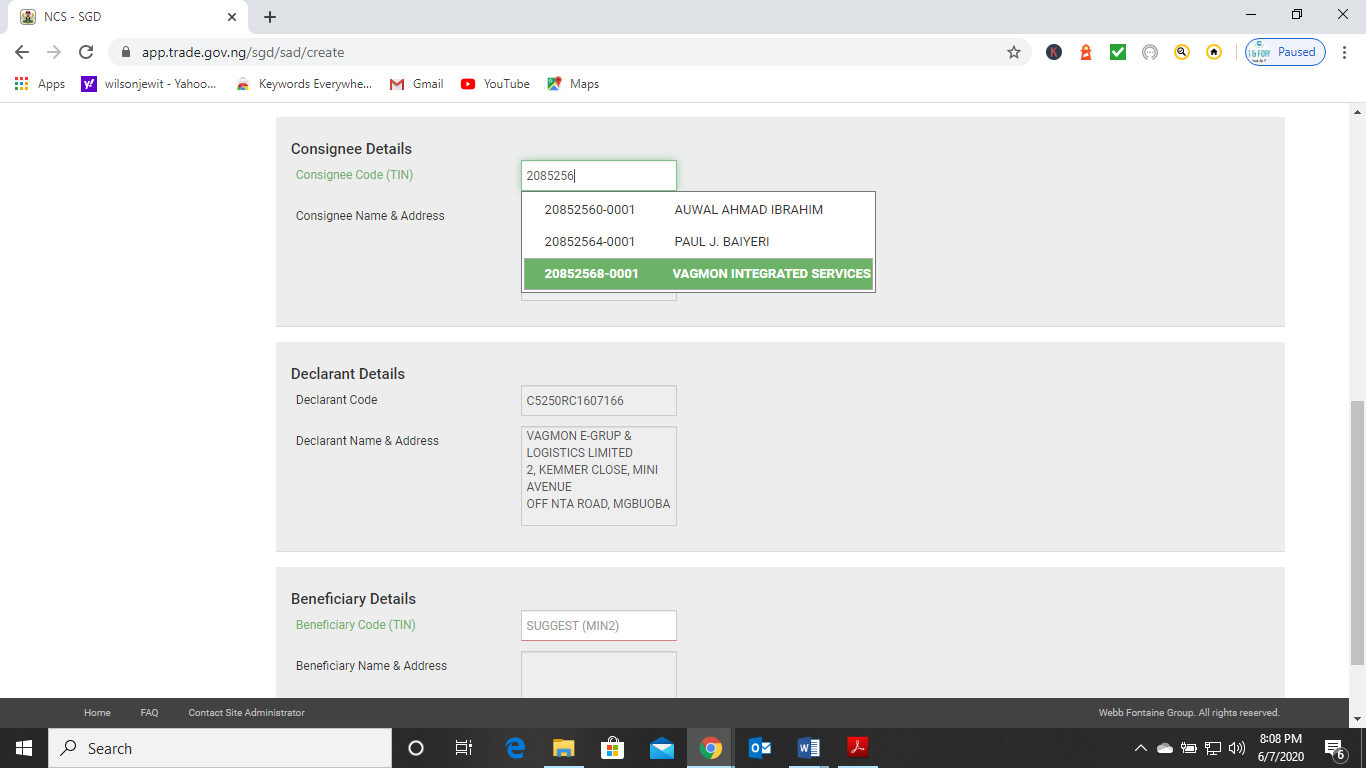

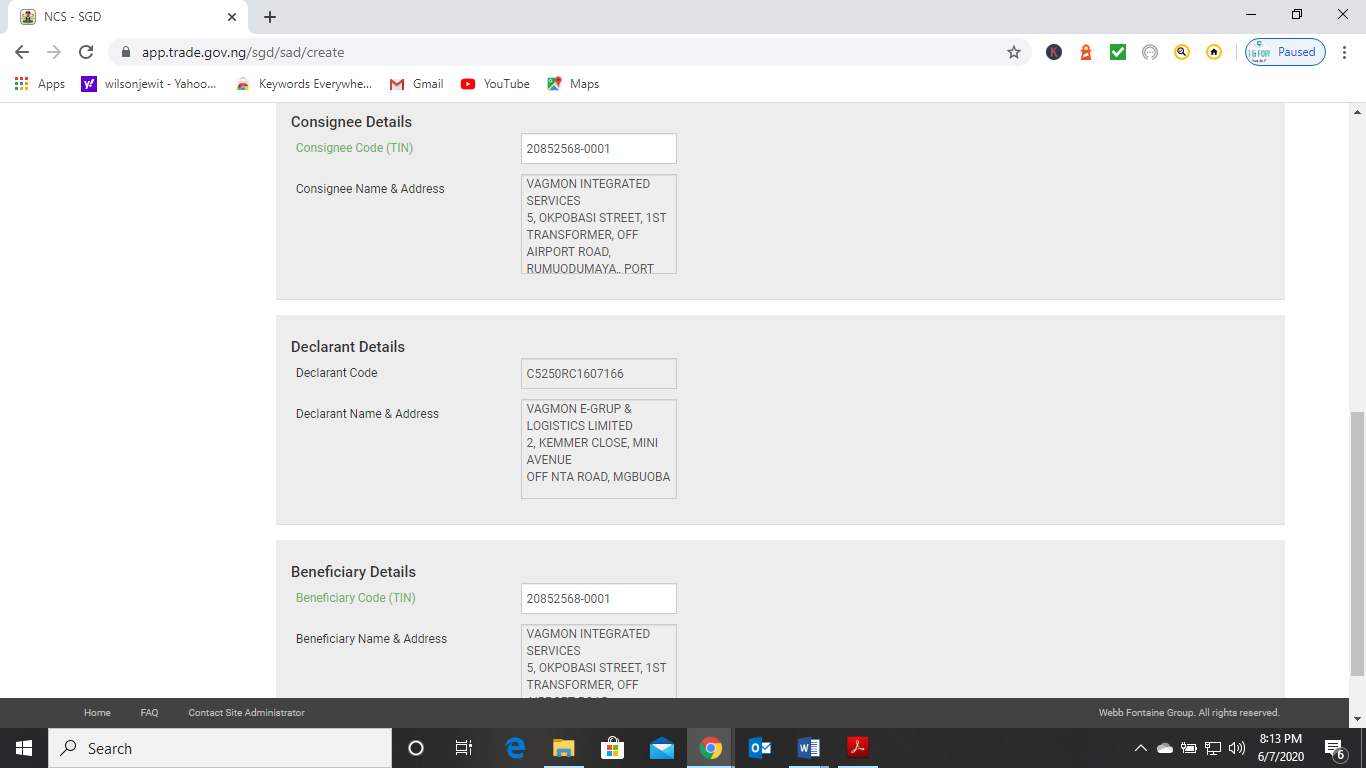

- In the consignee code (TIN), type the tax identification number of the consignee as in shipping documents and select the consignee from the list.

Once the consignee is selected, the company details will be populated in the column for consignee name and address. Notice also that the declarant detail is that of the licensed Agency.

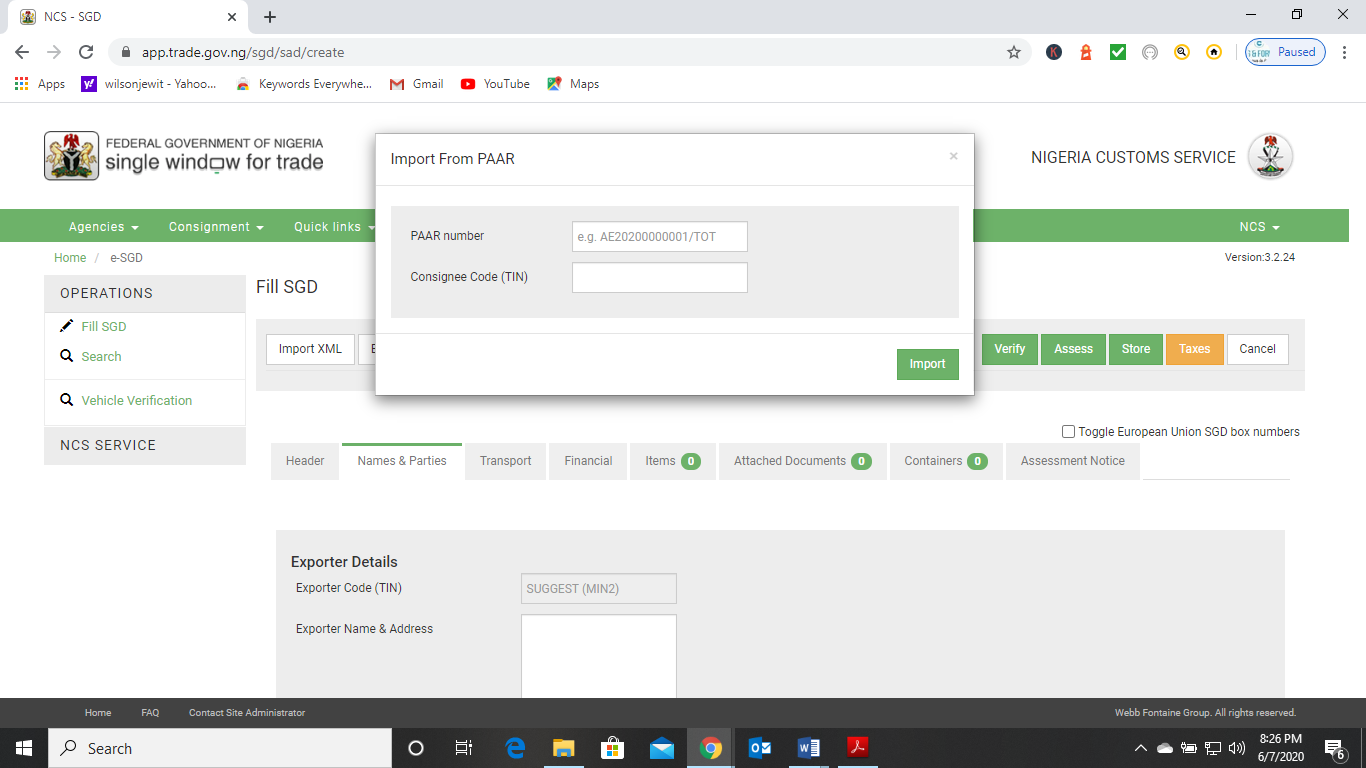

Import from PAAR

We mentioned in the last subheading that we jumped to ‘names and party’ tab because we want to import some data. The button for import from PAAR is where we want to import.

- Click the import from PAAR button shown below.

- Type in the PAAR consignment and the consignee TIN

- Click import.

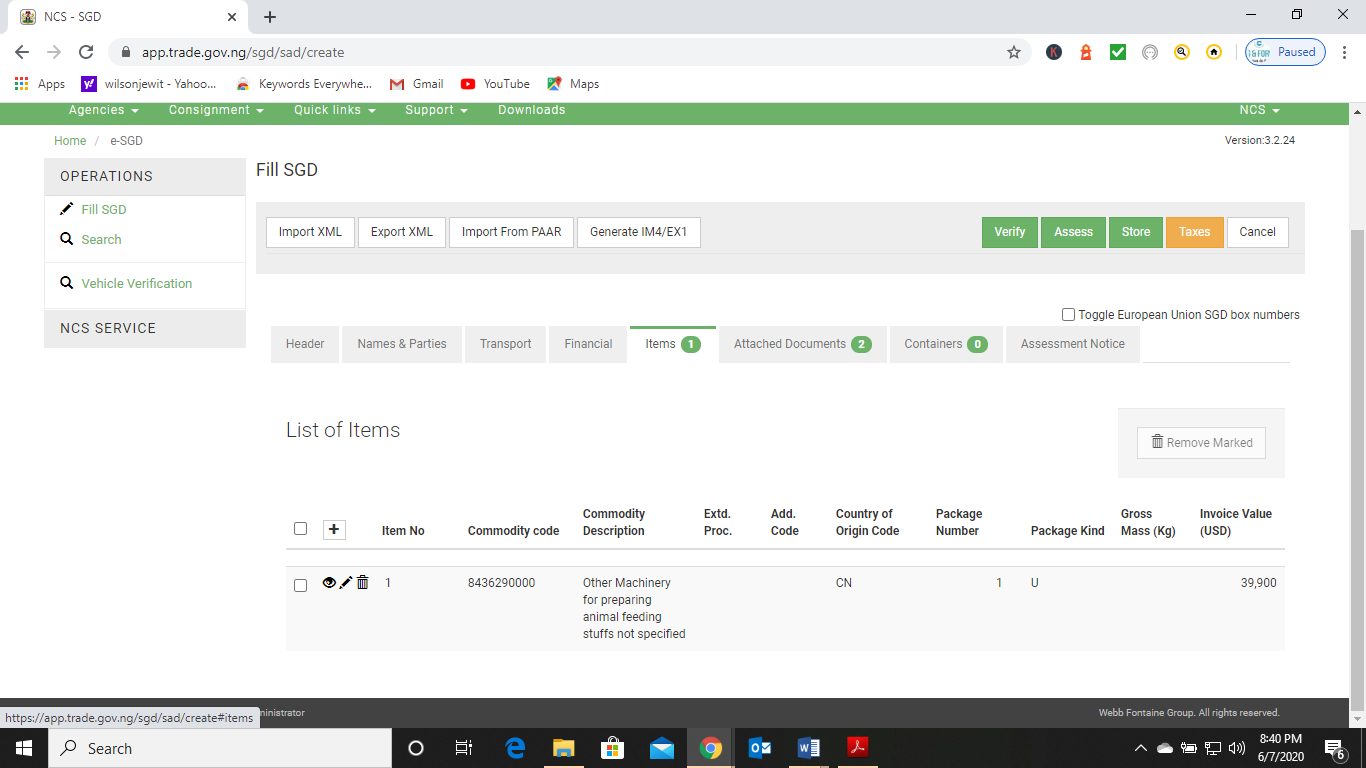

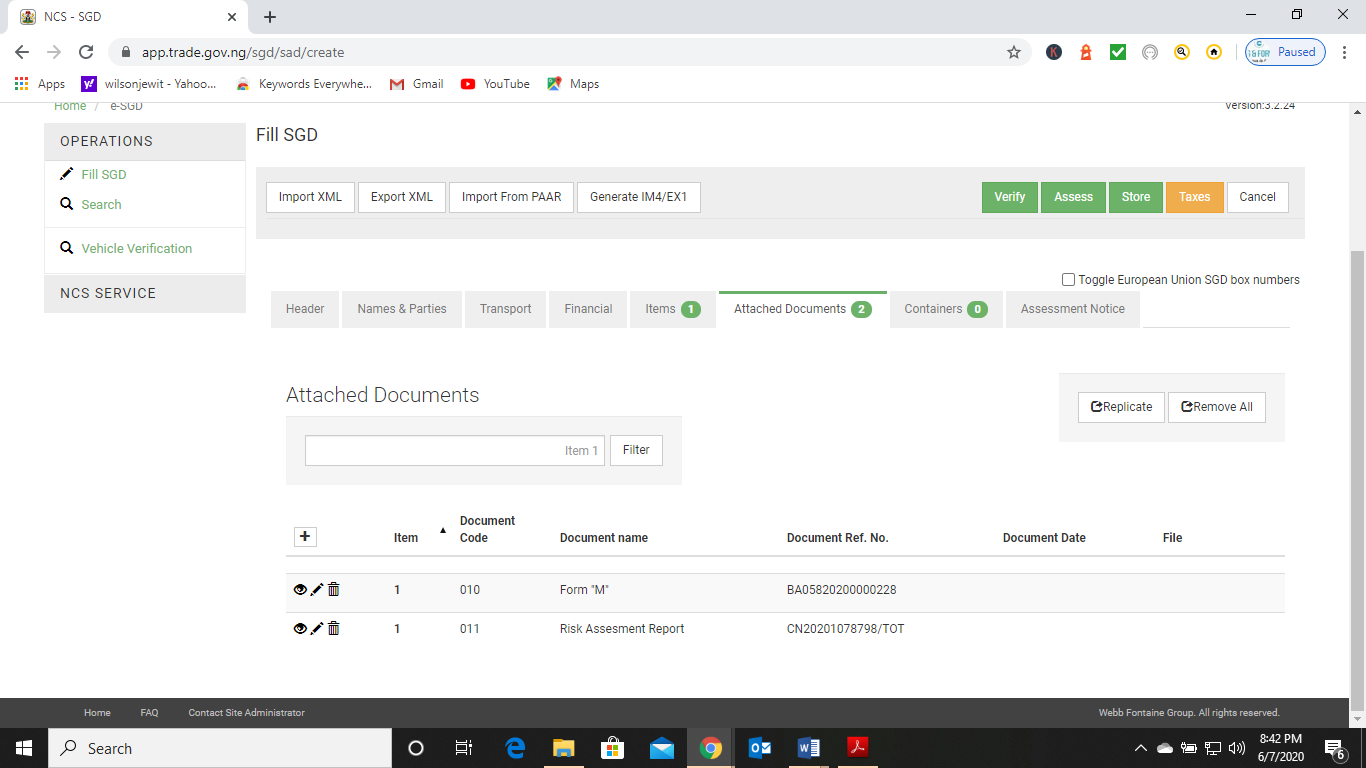

Consequently, you have filled the ‘items’ the ‘attached documents’ pages as shown below:

- Click on the ‘items’ tab to view that page, and see that its already filled.

- Also, click on the ‘attached documents’ tab to view that page as well.

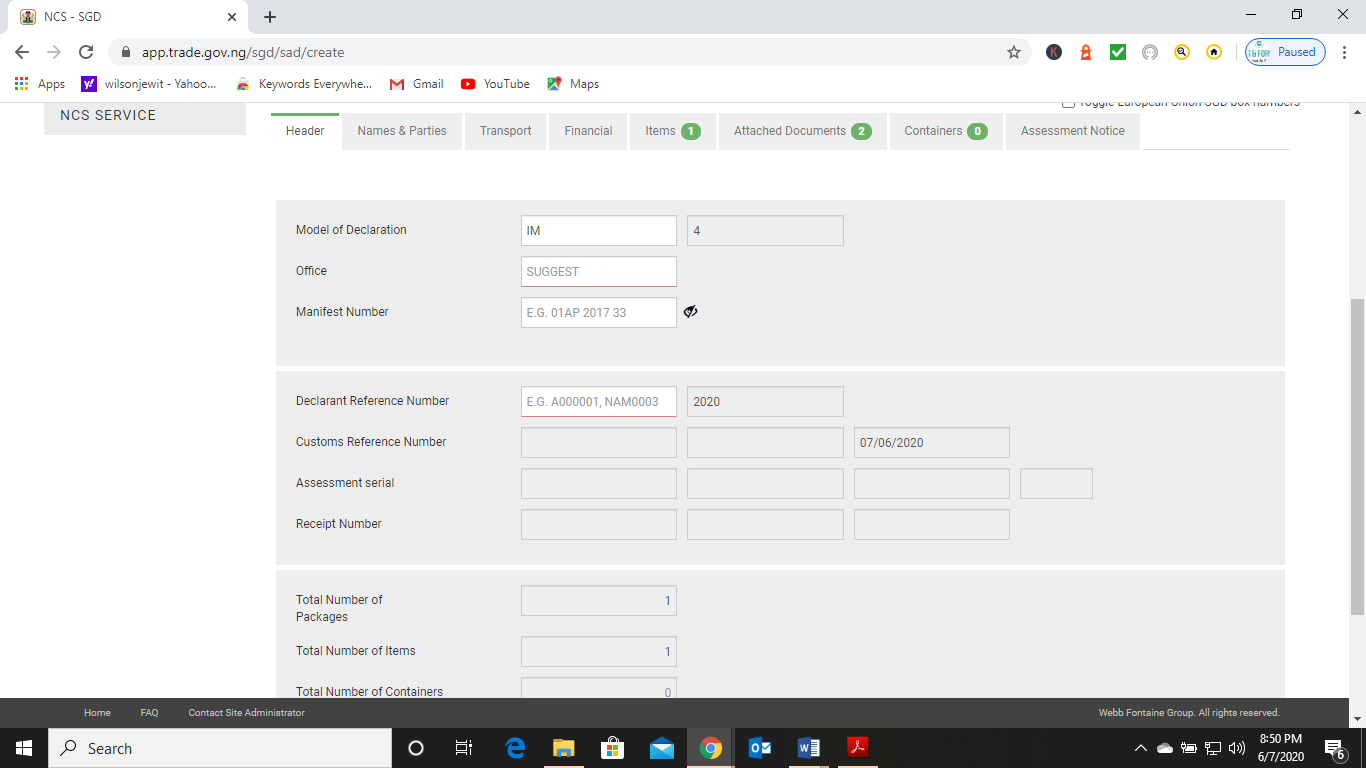

‘Header’

Let us now go back to the ‘header’ tab and page.

- Click header tab

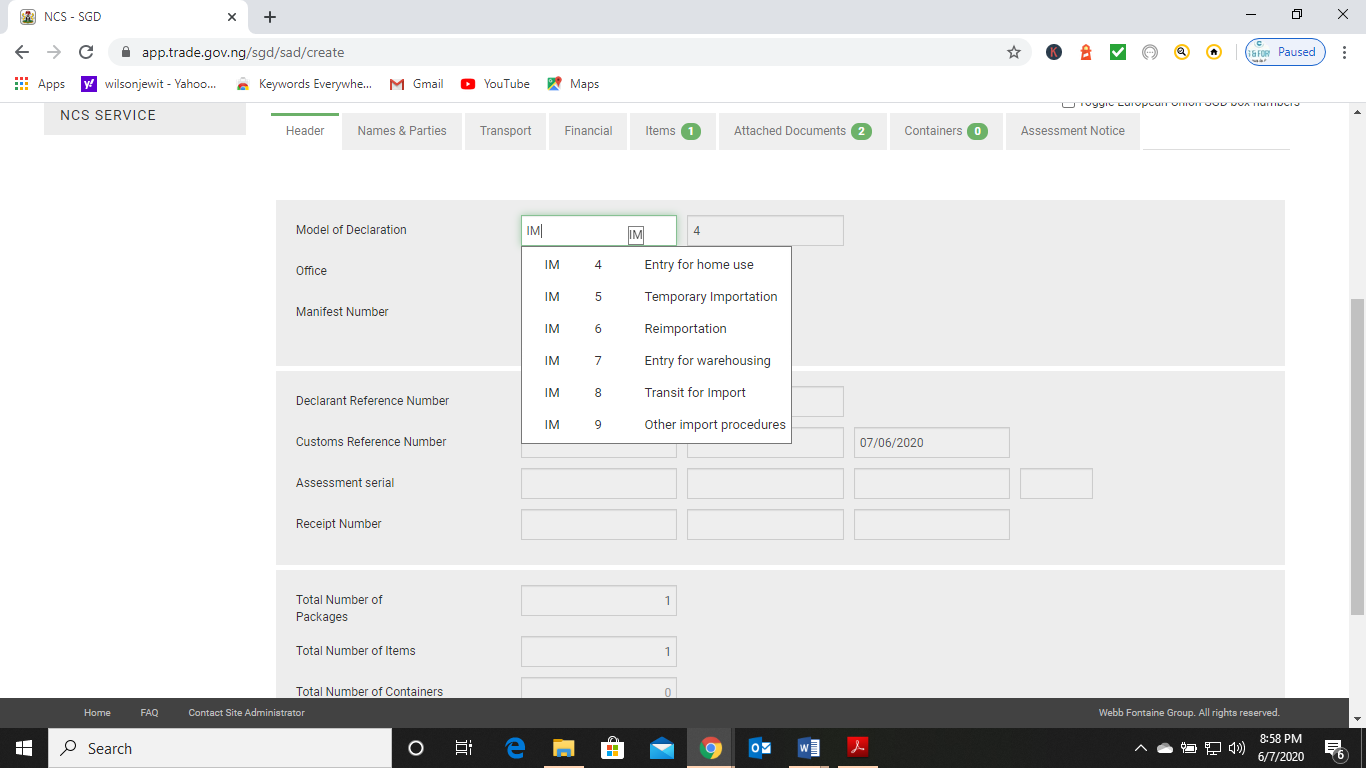

- Choose the mode of importation by clicking and selecting from the given options.

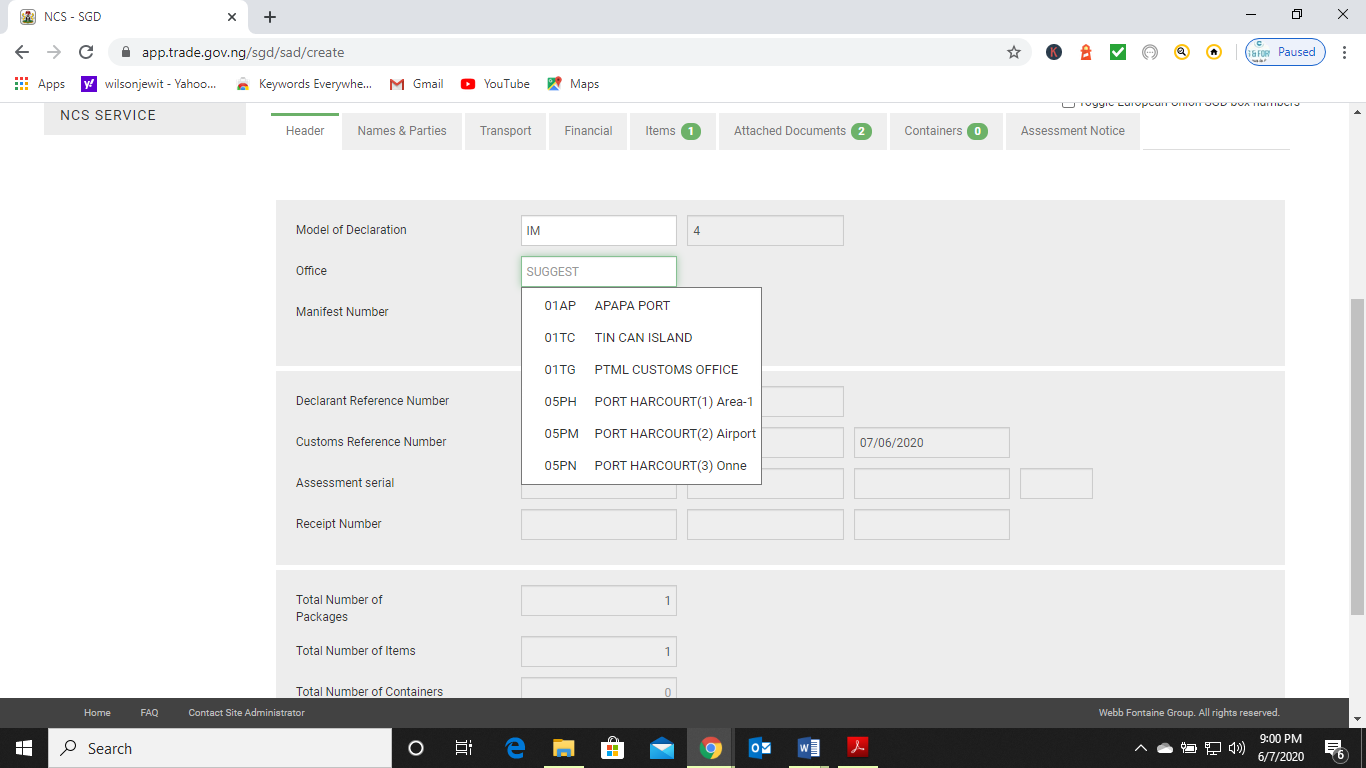

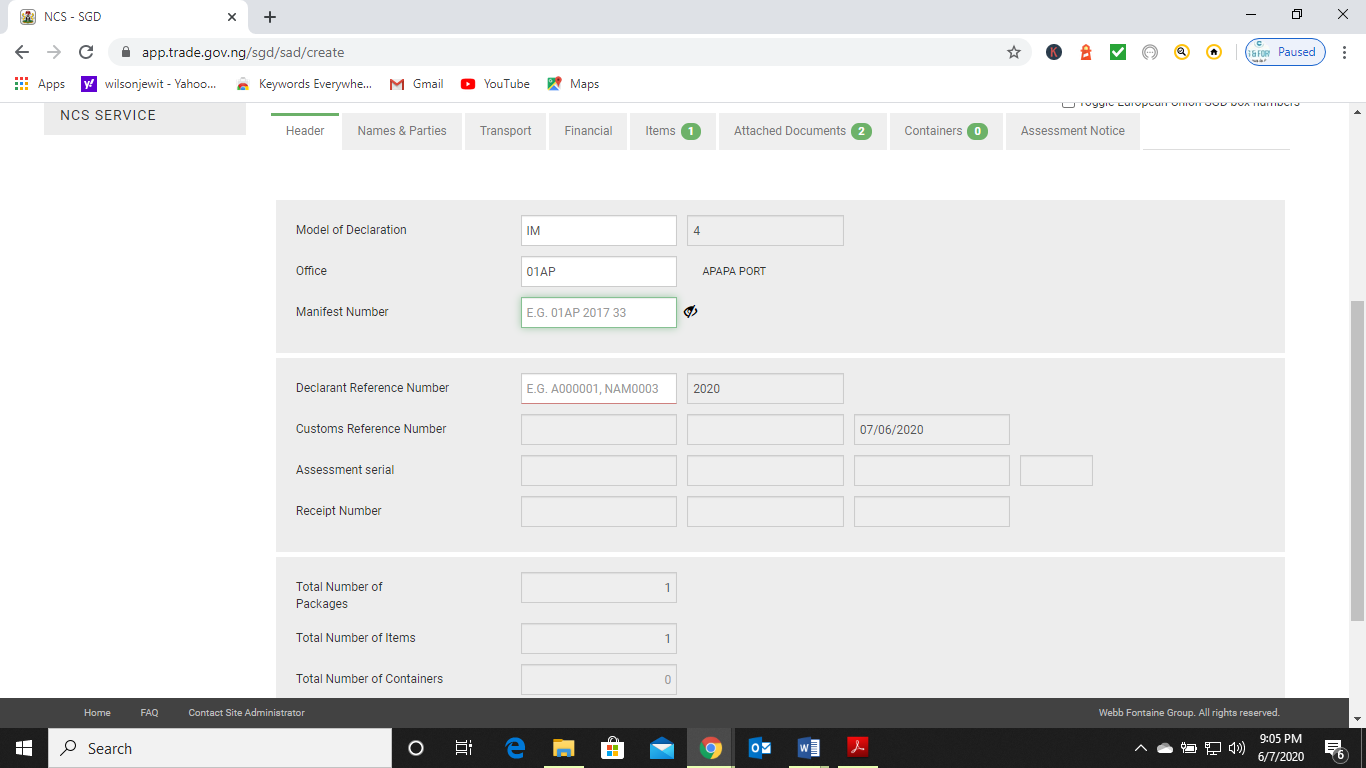

- Again, click and choose the office. By office, it means the command where cargo is.

- Enter the manifest number as given by the shipping company once cargo enters Nigeria. Notice how the manifest number looks, for example 01AP 2017 33 means Apapa command, year 2017 and the rotation number.

- Also, enter the declarant reference number

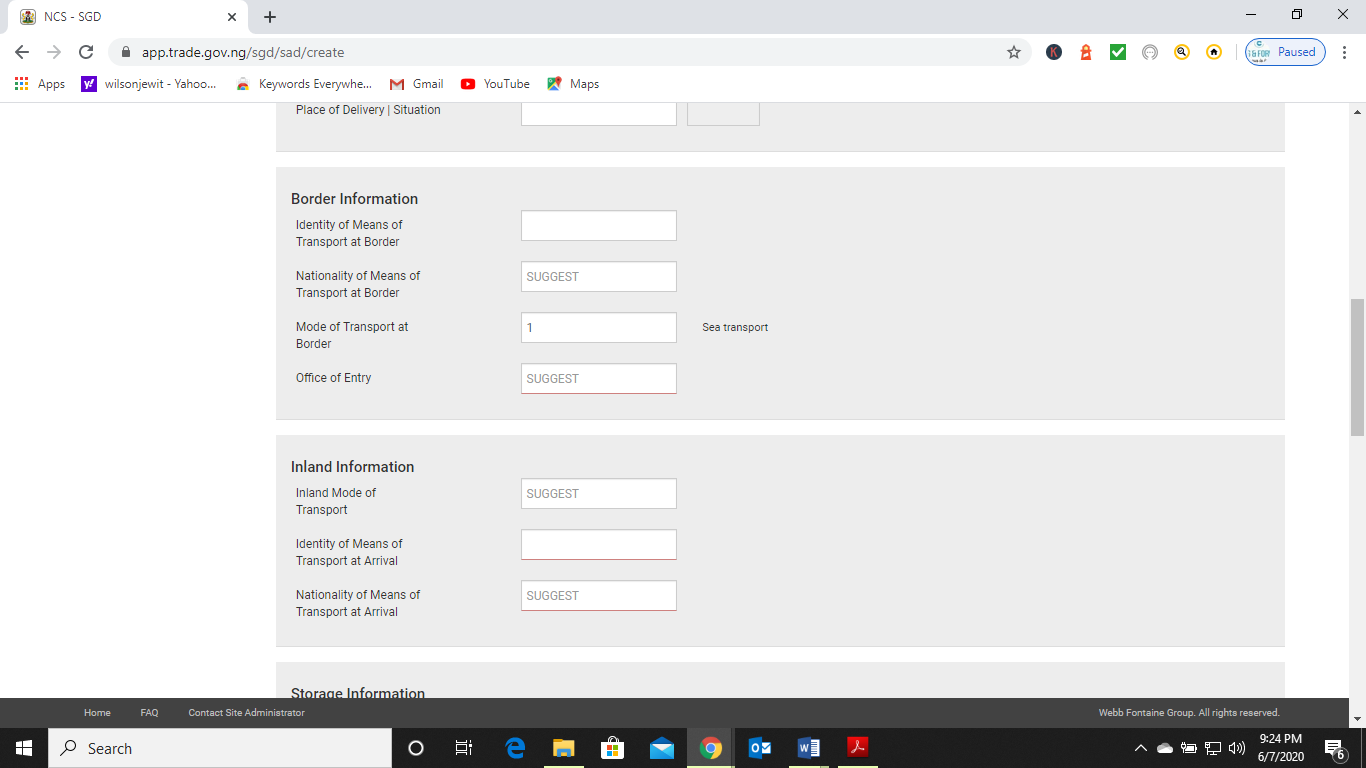

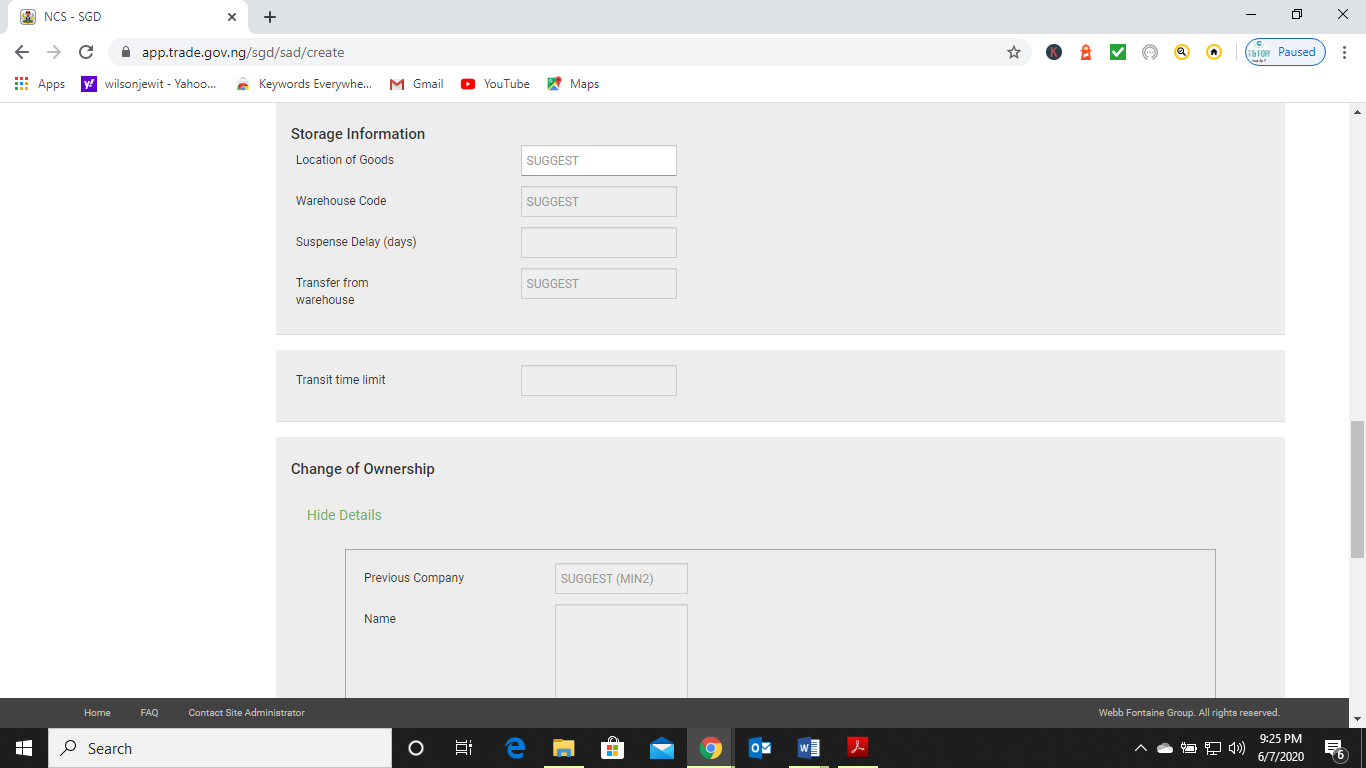

‘Transport’

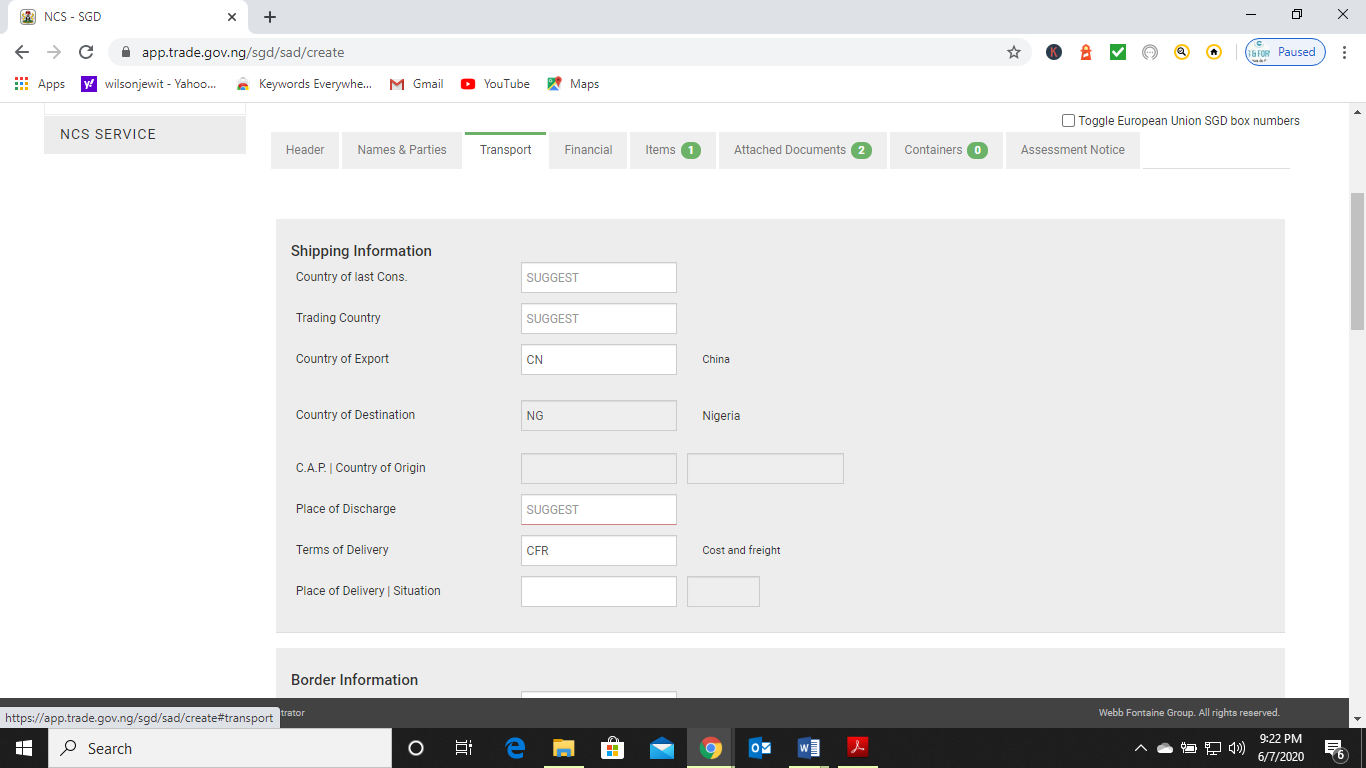

Complete this page by clicking on the button.

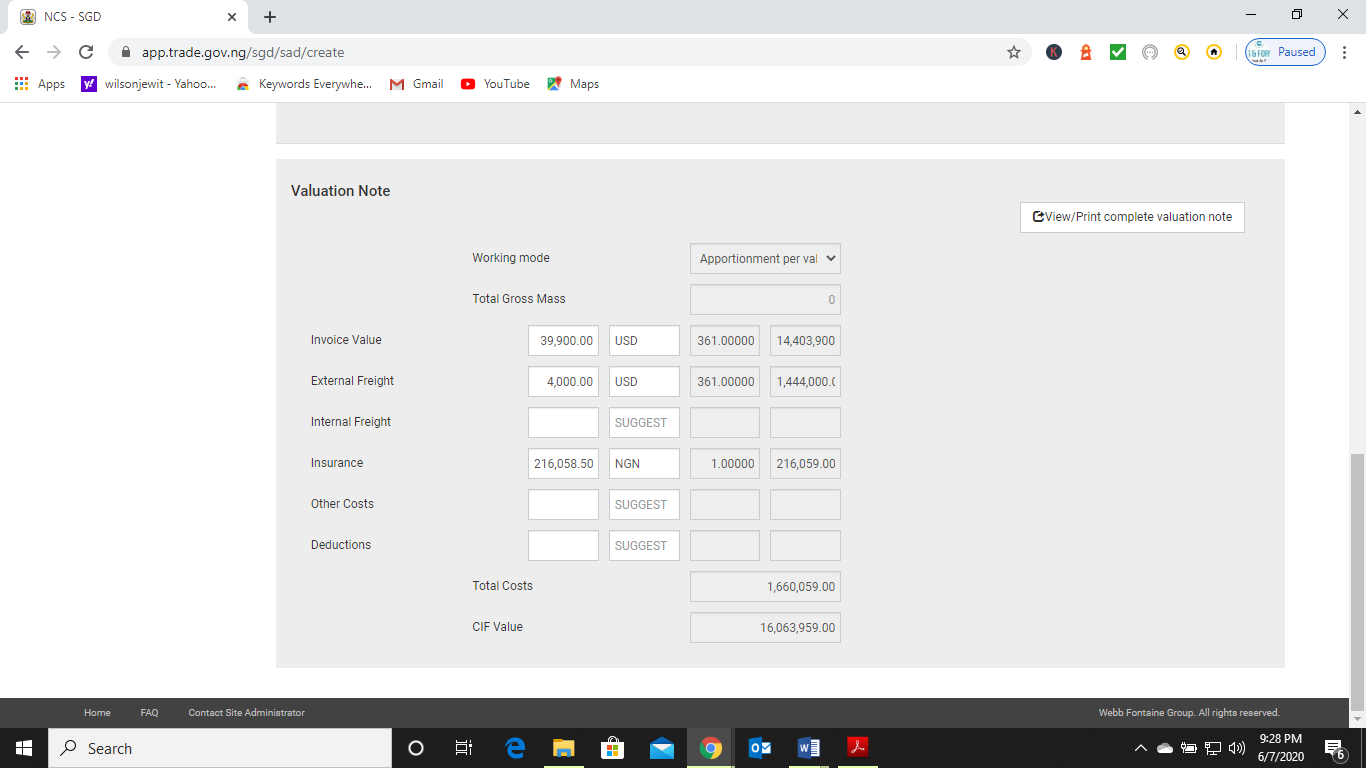

‘Financial’

Equally, complete the financial page as appropriate.

‘Containers’

Remember to check and ensure container details are entered properly.

Additionally, notice and play with the ‘verify’, ‘store’ buttons on the SGD platform. Click assess once verified that all information entered are correct and accurate.

Read Also SUCCESSFUL ONLINE BUSINESS DTI CAFE IN NIGERIA

CONCLUSION:

This article for Single Goods Declaration is intended to empower importers, Customs Brokers and the public on how to generate SGD/SAD. The article has shown that SGD is detailed, while SAD is the summary of such declaration. In Nigeria, SAD is also called the Assessment Notice. Some persons refer to SGD as face of entry; others call it bill of entry. Whatever the nomenclature used, both the SGD and SAD are Customs documents, and are required for cargo clearance. Without the SGD and SAD, the importer will be unable to pay for Customs duty for example.

Furthermore, this article and the views expressed are for academic demonstrations, and do not represent final say on the subject. Thus, the article is developing and will be updated regularly. Finally, feel free to contact us to clear your cargo and solve importation hassles.